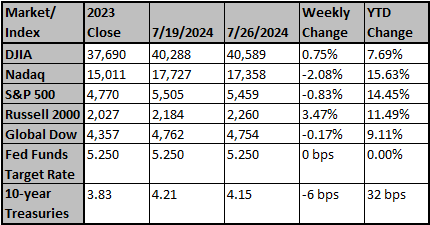

U.S. equities were mixed again last week with the S&P 500 (-0.82%) and NASDAQ lower (- 2.08%) and the small cap Russell 2000 (+1.77%). Big tech/momentum were the biggest decliners. Best sectors were utilities (+1.47%), healthcare (+1.41%), and materials (+1.37%); underperformers included communication services (-3.76%), technology (-2.44%), and consumer discretionary (-2.31%). The preliminary release of Q2 2024 U.S. GDP surprised to the upside (+2.8%) with the two largest drivers of t… View More

Authors

Post 41 to 50 of 562

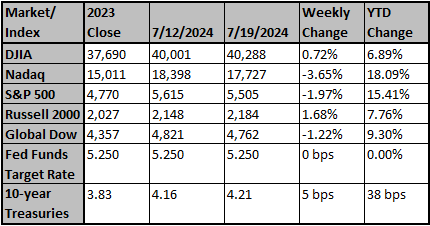

U.S. equity indexes were mixed last week with the market largely rotating out of big tech/momentum/growth into value/cyclicals/small caps. The S&P 500 Index was down (-1.95%); the NASDAQ fell (-3.65%); and the Russell 2000 Index was up (+2.33%). Themes included soft-landing hopes, expectations for a Fed rate pivot, and a surge in the “Trump trade.” Best sectors were energy (+2.06%), real estate (+1.32%), and financials (+1.19%); worst sectors were technology (-5.14%), communication servi… View More

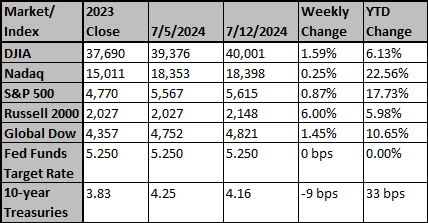

Stocks ended higher last week (S&P 500 +0.87%), with small caps and equal-weight S&P 500 strongly outperforming the other major indexes following the post-CPI rotation out of big tech. The best performers were real estate (+4.37%) and utilities (+3.90%); the only negative sector was communication services (-3.57%). Headline June CPI declined 0.1% m/m (versus consensus of +0.1%) (up 3.0% y/y). It was the first monthly drop since July 2022. Core CPI was +0.1% m/m (+0.2% consensus) a… View More

In 1852, Karl Marx said "Men make their own history, but they do not make it as they please; they do not make it under circumstances chosen by themselves, but under circumstances directly encountered and transmitted from the past." He, obviously knew about the Magna Carta (1215) and the English Parliament’s Bill of Rights (1689), which created a separation of powers between the King and elected representatives. What he didn’t pay much attention to was how the United States had improved upon… View More

1. An AI search uses 10x the amount of electricity than that of a Google search. 2. The EIA expects global electricity usage from data centers to increase by 540 terawatts from 2022 to 2026. “This is roughly the equivalent of the electricity usage of Japan” in one year. 3. Despite government subsidies, natural gas provides 10x the amount of electricity to the American power grid than does solar. 4. Coal still provides 16% of America’s electricity generation, according to the EIA. 5. Th… View More

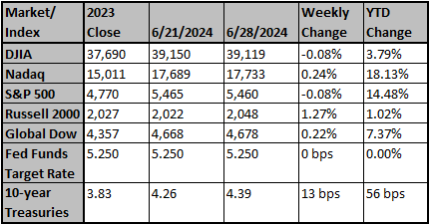

U.S. equities were mixed last week. The S&P 500 (+1.58%) and NASDAQ posted solid gains, while the Dow and Russell 2000 were both lower. Breadth was narrow again. The upside was driven in large part by another rate rally and more soft-landing optimism. The best sector was technology (+6.43%); the worst sectors were energy (-2.29%) and financials (-1.97%). Key takeaways: The U.S. CPI was flat m/m (3.3% y/y) and core (except food and energy was+ 0.2% m/m (3.4% y/y) in May. While the downsid… View More

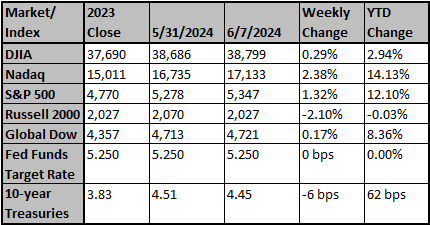

Equities advanced last week (S&P 500 +1.36%) as the S&P 500 and NASDAQ hit new all-time highs. Breadth was narrow as the equal weight S&P fell for the week. Best-performing sectors were technology (+3.83%) and healthcare (+1.96%); laggards included utilities (-3.81%) and energy (-3.41%). May non-farm payrolls increased 272,000 well above consensus. The unemployment rate rose to 4.0%. the highest level in over two years. Disappointing for potential Fed rate cuts, average hourly ear… View More

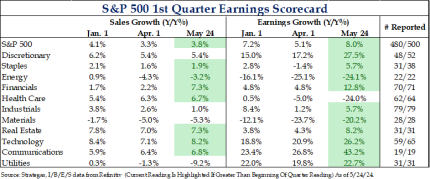

After Nvidia reported last week, the first quarter earnings season is nearly complete, and overall, it was strong. The overall index grew at 8.0%, which was better than the January 1st expected growth rate of 7.2%. Revenues were at 3.8%, a touch lighter than the January 1st estimate of 4.1%, with the drag coming from Utilities and Materials. Despite not having strong growth rates, financials were the standout sector as their growth expectations exceeded estimates even before the collapse of SVB … View More

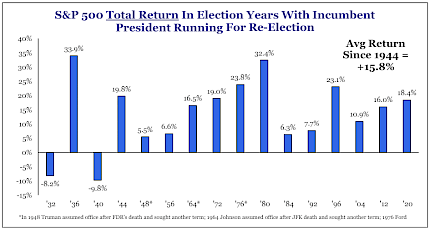

Now that we are past Memorial day in an election year, all eyes are on the upcoming election. We get a lot of questions as to what the market usually does in election years. I thought it would be helpful to share some information on what we should expect. Macro/Pre-Election: Policymakers Will Keep Liquidity/Stimulus Flowing In 2024 S&P 500 has increased in every presidential reelection year since 1944 as sitting presidents stimulate the economy ahead of their reelection. Average retu… View More

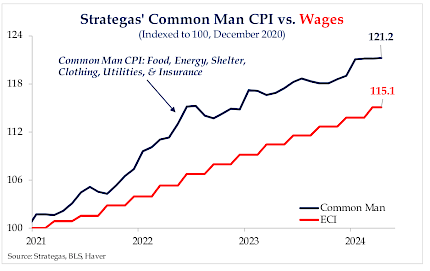

The primary justification for excluding food and energy from the Bureau of Labor Statistics’ “core” CPI number is that the data are noisy and, therefore, difficult for economists to forecast. Naturally, that raises another question: Does the data exist for economists and policymakers to make their decisions, or do they exist for regular people when deciding how to run their economic lives? Excluding food, energy, and housing from the “supercore” measure seems a little much because, le… View More