U.S. equities rose for the fifth week in a row (S&P 500 +1.13%) closing at an all-time high. Banks were strong as Friday earnings boosted the stocks. Treasuries were weaker (the 10-year yield is up 35 basis points [bps] over the past eight sessions.) Best sectors were technology (+2.51%) and industrials (+2.11%); worst sectors were utilities (-2.55%) and communication services (-1.28%). Key takeaways: Core CPI was +0.3% (above consensus of 0.2%). Headline CPI was +0.2% (above con… View More

Authors

Post 31 to 40 of 562

While 2Q24 was characterized by narrow market leadership and a hawkish repricing of Fed rate-cut expectations, 3Q saw solid performance from a wider spectrum of companies and increasing expectations for rate cuts in 2024. Please see our 3Q Review below for additional insight... 3Q Review U.S. equities rose again in Q3 for the fourth consecutive quarter (S&P 500 +5.5%. NASDAQ +2.6%, and Russell 2000 +8.9%). The S&P 500 hit all-time highs in mid-July but slid in early August, rallyin… View More

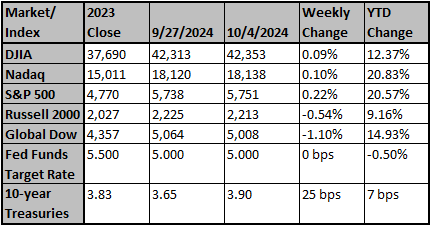

Stocks advanced again last week (S&P 500 +0.64%) as the equal-weighted index continued to outperform the cap-weighted index. The big stories last week included the China stimulus and a respectable core PCE report. The best sectors were materials (+3.39%) and consumer discretionary (+1.75%); the worst sectors included healthcare (-1.11%) and energy (-0.82%). The U.S. economy is beginning to struggle due to high price levels, high and rising consumer debt, and, in many industries,… View More

This is the second-longest period between the Fed's last rate hike and the first cut (146 days). However, the return during the current pause has been the strongest. Going back to 1995, Consumer Staples, Health Care, and Utilities have been the strongest performing sectors after the first Fed rate cut in a series. The real 10-year Treasury yield and the real Fed Funds rate are approaching levels that preceded recessions and would be considered “tight.” The price of gold has risen 35% in… View More

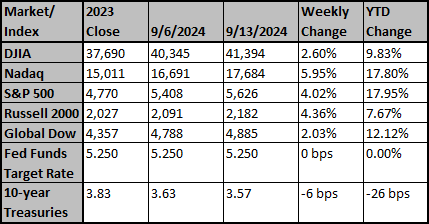

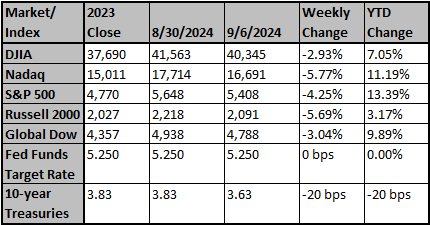

Friday’s employment report suggests the US economy may be slowing down faster than most investors think. Nonfarm payrolls increased by 142,000 in August, but revisions to June and July brought the net gain down to a modest 56,000. And the details were worse. We like to follow payrolls excluding three sectors: government, education & health services, and leisure & hospitality, all of which are heavily influenced by government spending and regulation (including COVID lockdowns and reope… View More

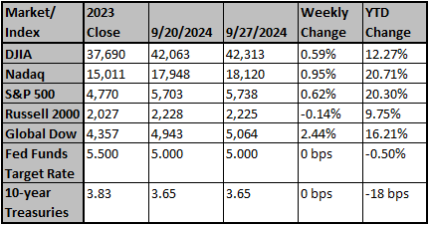

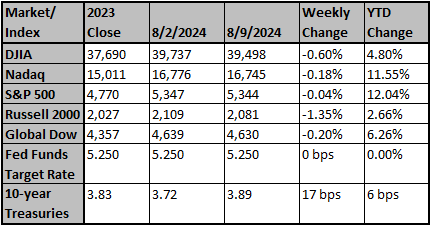

Stocks put in a mixed performance last week as the S&P 500 increased (0.27%) but the NASDAQ fell (-0.91%). Treasuries were weaker with the yield curve steepening. Discussion revolved around AI (especially Nvidia’s earnings) and the Fed’s attempt at a soft landing. Best sectors were financials (+2.95%) and industrials (+1.71%); worst sectors were technology (-1.47%) and communication services (-0.69%). U.S. Q2 GDP growth was unexpectedly revised up to 3.0% from 2.8%. All the focus… View More

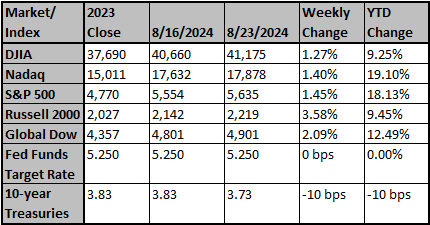

Stocks were higher last week (S&P 500 +1.47%) as all major averages gained. Most averages remained below the July all-time high. The big focus was on the Fed and Chairman Powell’s strong endorsement of lower rates. Best sectors were real estate (+3.68%), materials (+2.39%), and consumer discretionary (+2.10%); worst sectors were energy (-0.28%), technology (+1.08%), and communication services (+1.20%). Chairman Powell stated clearly,"... the balance of risks to our two mandates has … View More

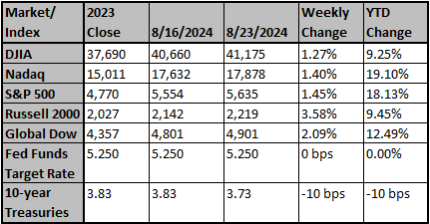

Our research provider follows inflation, which affects us every day. The Strategas Common Man CPI is comprised of items people must buy each day, week, or month – food, energy, shelter, children’s clothing, utilities, and insurance. Real wages may have started to improve recently, but the cumulative effects of inflation indicate that the “common man’s” standard of living has deteriorated in the last four years. January 2021 January 2017 Source: Strategas Chart ref… View More

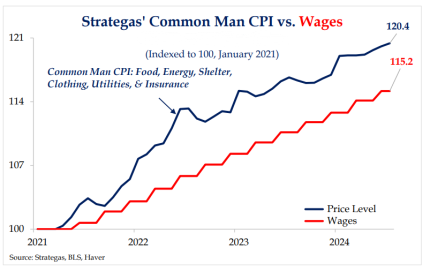

Stocks were down last week (S&P 500 -0.02%), although they nearly recovered from a significant decline on Monday (worst day in two years). A weaker-than-expected payroll report ignited fears about a behind-the-curve Fed and a potential hard landing. Best sectors were industrials (+1.22%) and energy (+1.19%); worst sectors were materials (-1.68%) and consumer discretionary (-1.00%). The cause of the sell-off included: escalating concerns about an economic slowdown in the U.S., heighten… View More

There are certainly pockets of the market more deeply oversold than others after the last few days, but on balance, we’d still stop short of calling this enough of a rinse to really lean into yet. It might be an easier call if it was October, but we frankly struggle to think of many markets that have put in their corrective lows in early August. Here’s a summary of our current thinking, but reach out with questions or requests—we’re available to help in any way. On a scale of 1 to… View More