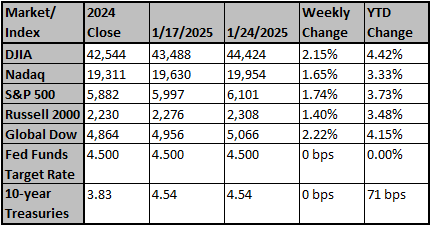

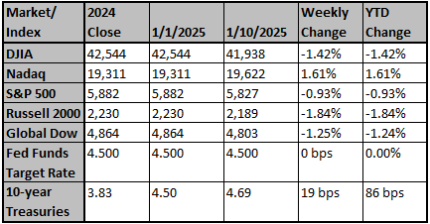

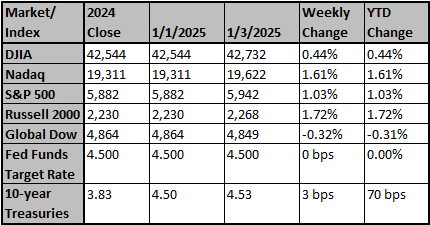

Global financial markets have hit a rough patch as the cumulative impact of President Trump’s trade and related economic threats are fueling concerns that he will diverge from the pro-growth script that he initially followed during his first term. Then, the positive economic elements arrived first, primarily tax cuts, before the negative actions followed, i.e., a brief trade war. These negative actions caused a downturn in global trade and slowed the U.S. economy and corporate profits. The U.… View More

Authors

Post 11 to 20 of 562

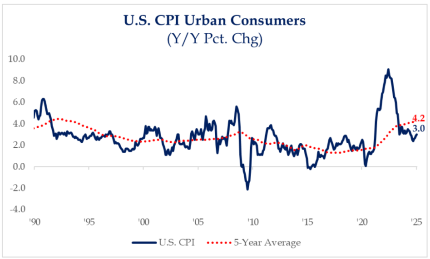

We don’t want to over-emphasize the importance of one data point, but the data over the last several months suggest that the progress toward the Fed’s much-vaunted goal of 2% inflation has slowed. In truth, the 2% target is a widely agreed-upon fiction among both policymakers and market participants themselves borne out of a New Zealand central bank paper from the late 1980s. Ironically, the target was only invoked when inflation was serially below 2% in the aftermath of the GFC. Since the … View More

There is nothing easy about forecasting financial markets, and when combined with a President who changes his mind in a matter of moments on policies that may a have lasting impact on sectors, industries, or specific companies, it becomes that much more challenging. Three weeks into Trump 2.0 we felt it was as good a time as any to review our sector recommendations. We feel being overweight the Financials, Industrials, Utilities and Energy sectors remains a prudent strategy. The deregulation st… View More

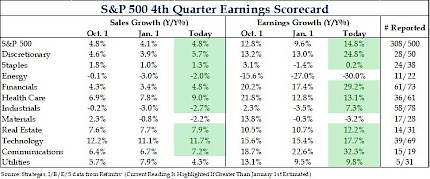

With the fourth quarter reporting season more than 60% reported, both earnings and sales growth have been quite strong. EPS growth is expected to be 14.8%, with 9 of the 11 sectors exceeding estimates from the start of the quarter. Sales growth is also expected to be strong overall with estimates sitting at 4.8%, with 9 of 11 sectors currently exceeding estimates from the beginning of the reporting season. While there is still 40% of the index left to report, there are few that could really swa… View More

Following 100 basis points in rate cuts through the back half of 2024, the Fed started 2025 with a pause, placing itself in wait and see mode for the foreseeable future. Starting with today’s FOMC statement, there were a few language changes worthy of note. On the employment front, prior comments that labor market conditions have eased and the unemployment rate has risen, now state that the unemployment rate has stabilized and labor market conditions “remain solid.” With regards to inflat… View More

Nvidia Corp. and ASML Holding NV shares plunged early Monday as Chinese artificial intelligence startup DeepSeek appeared to provide comparable performance to Western chatbots at a fraction of the price. Nvidia shares fell about 9% in premarket trading, while ASML’s shares dropped as much as 11% to €626.20 apiece in Amsterdam trading, the biggest intraday drop since Oct. 15. The technology heavy Nasdaq 100 futures index also slumped. The latest AI model of DeepSeek, released last week, is … View More

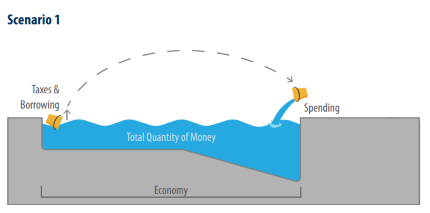

Is Government Spending Inflationary? The stimulus bills approved by Congress starting in 2020 led to the largest surge in government spending in history, coinciding with a sharp rise in inflation. This has led many to assume that government spending itself caused inflation. But is that assumption correct? In today's "Three on Thursday," we explore whether government spending inherently leads to inflation. Milton Friedman famously stated, "Inflation is always and everywhere a monetary phenome… View More

Looks like this was just primping from the Fed in an election year and now we need to deal with reality. The bond market is always right, and it is indicating that rates are probably not going lower, and inflation is probably not in our rearview mirror. Lower returns in the year ahead seem inevitable, especially given already rich equity valuations and prospects for higher bond yields. Inflation will prove stickier and higher than central banks and markets are forecasting. That implies that cen… View More

Continuing a yearly tradition, Bob Doll, chief investment officer of Crossmark Global Investments, has released his 10 market and economic predictions for 2025. During 2025, the economy will slow, and unemployment will creep up, according to Doll. These are his other predictions: Inflation remains sticky and fails to reach the Fed's 2% target, causing Fed funds rate to fall less than expected. Treasury 10-year yields trade primarily between 4% and 5% as credit spreads widen. Earnings … View More

The buzz (can we say, vibe?) surrounding the newly established Department of Government Efficiency (DOGE) is undeniable. But the question remains: can DOGE truly deliver on their promise to reduce government spending? Proposing an extensive list of programs to cut is one thing—implementing those cuts is another. This isn’t the first time a president has launched a commission to identify ways to trim government expenses. The best comparison to today’s DOGE is the Grace Commission, formally… View More