U.S. equities were mixed last week. The S&P 500 (+1.58%) and NASDAQ posted solid gains, while the Dow and Russell 2000 were both lower. Breadth was narrow again. The upside was driven in large part by another rate rally and more soft-landing optimism. The best sector was technology (+6.43%); the worst sectors were energy (-2.29%) and financials (-1.97%). Key takeaways: The U.S. CPI was flat m/m (3.3% y/y) and core (except food and energy was+ 0.2% m/m (3.4% y/y) in May. While the downsid… View More

Authors

Post 91 to 100 of 607

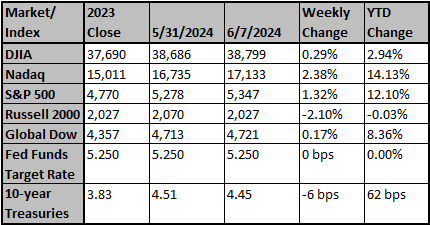

Equities advanced last week (S&P 500 +1.36%) as the S&P 500 and NASDAQ hit new all-time highs. Breadth was narrow as the equal weight S&P fell for the week. Best-performing sectors were technology (+3.83%) and healthcare (+1.96%); laggards included utilities (-3.81%) and energy (-3.41%). May non-farm payrolls increased 272,000 well above consensus. The unemployment rate rose to 4.0%. the highest level in over two years. Disappointing for potential Fed rate cuts, average hourly ear… View More

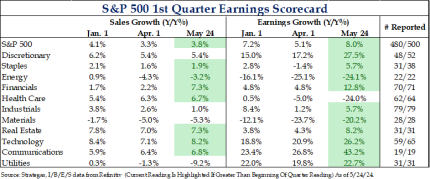

After Nvidia reported last week, the first quarter earnings season is nearly complete, and overall, it was strong. The overall index grew at 8.0%, which was better than the January 1st expected growth rate of 7.2%. Revenues were at 3.8%, a touch lighter than the January 1st estimate of 4.1%, with the drag coming from Utilities and Materials. Despite not having strong growth rates, financials were the standout sector as their growth expectations exceeded estimates even before the collapse of SVB … View More

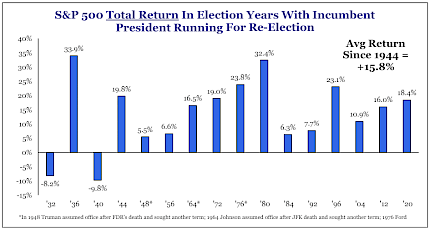

Now that we are past Memorial day in an election year, all eyes are on the upcoming election. We get a lot of questions as to what the market usually does in election years. I thought it would be helpful to share some information on what we should expect. Macro/Pre-Election: Policymakers Will Keep Liquidity/Stimulus Flowing In 2024 S&P 500 has increased in every presidential reelection year since 1944 as sitting presidents stimulate the economy ahead of their reelection. Average retu… View More

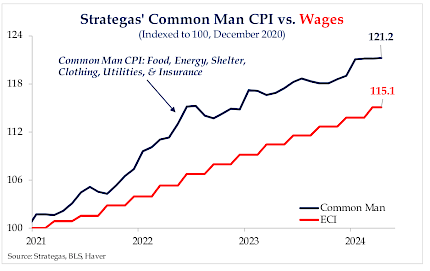

The primary justification for excluding food and energy from the Bureau of Labor Statistics’ “core” CPI number is that the data are noisy and, therefore, difficult for economists to forecast. Naturally, that raises another question: Does the data exist for economists and policymakers to make their decisions, or do they exist for regular people when deciding how to run their economic lives? Excluding food, energy, and housing from the “supercore” measure seems a little much because, le… View More

One theory making the rounds is that if President Trump gets back into office, inflation will surge. The idea is that if he returns, Trump will raise tariffs, reduce immigration, and jawbone the Federal Reserve to cut interest rates too much, all of which could push inflation higher, maybe even to where it was a couple of years ago when it peaked at 9.1%. We are certainly not optimistic about the path of inflation in the decade ahead. The Consumer Price Index (CPI) went up at only a 1.8% annual… View More

No shortage of things to discuss after today’s Fed statement and subsequent press conference. While the Fed did not cut rates – and nobody expected them to – today’s focus was on how the Fed would respond to the turn higher in inflation to start 2024. But for all the questions, there was a distinct lack of clear answers. Let’s look first at today’s Fed statement, which included more changes than usual. In particular, a new sentence was added noting that “there has been a lack of f… View More

After three straight weekly declines, equities were higher last week (S&P 500 +2.68%). Corporate earnings, especially big tech, were a key driver. Best sectors were technology (+5.11%) and consumer discretionary (+3.52%); worst sectors were materials (+0.66%) and energy (+0.74%). 1Q GDP came in lower than expected (1.6% vs 2.4%), but internals were generally okay. Core PCE inflation, however, was expected to be 3.4% but instead came in at 3.7%. After last week's stronger than expecte… View More

Stocks were on a roller coaster most of the week (S&P 500 -3.1%, Dow Jones +0% and NASDAQ -5.5%). Dominating the discussion were the geopolitical volatility in the Middle East and hawkish Fed rate conversation. The best performers were utilities (+1.9%) and consumer staples (+1.4%); the worst performers were technology (-7.3%) and consumer discretionary (-4.5%). 1. Fed Chair Powell sounded more hawkish, stating that it is likely to take longer than previously thought to achieve confiden… View More

The breakout in rates, combined with the bid to USD, strength from Oil, and the persistence from Gold, all conspired as motivation to tactically raise our guard over recent weeks. But one of the more difficult pursuits in this business is differentiating between a modest corrective phase vs. the start of something more sinister. Our base case is that this near-term weakness should be viewed as the former, but we’re incrementalists and always on guard for challenges to that thinking. About 45%… View More