Each year we like to post the 10 predictions from our friend Bob Doll. This week, Bob Doll reviews the predictions he made in December 2023 to see how they measured up. He did better than most with his below predictions. We will pass on his 2025 predictions after the first of the year. Happy Holidays from all of us at Fortem Financial Summary The U.S. stock market has experienced back-to-back years of 25+% returns. While a handful of stocks account for the majority of returns, most… View More

Authors

Post 21 to 30 of 562

Until relatively recently, it was a decent bet that the second half of a President’s term would be better for market performance than the first. Generally speaking, Presidents would make the hard decisions when their political capital was at its highest and then it let it rip as they sought reelection. All that seemed to change with the election of President Obama, the introduction of QE, and the budget deficits that accompanied it. Since 2005, the best year for market returns has been the fi… View More

As December gets underway, here’s a quick bullet point update on our “base case.” The market’s primary trend remains up with 77% of S&P 500 issues above the 200-day moving average and seasonality a strong tailwind through January… …But, leadership is still evolving – Tech’s complete grip on the market has eased considerably since summer and the sector has split (e.g., Software vs. Semis). Cyclicals continue to carry the flag of leadership, particularly Financials and… View More

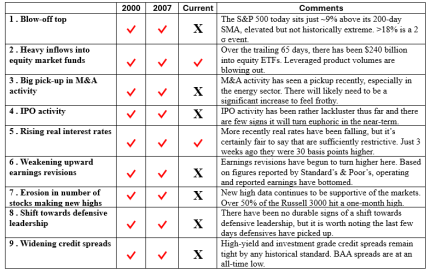

Although they might register as barely more than a whisper on the decibel meter, requests for our Bull Market Top Checklist have started to trickle in recently as investors start to fear that the market is becoming a bit frothy. With the price of Bitcoin over $98,000 and an artwork that consists of a banana duct-taped to a wall selling for $6.2 million at Sotheby’s two days ago, it is understandable that some market participants are starting to worry about “irrational exuberance.” (Ironica… View More

'Tis The Season Don’t forget to give to charity As the end of the year and the holiday season approaches, we will all see an uptick in the number of charitable solicitations arriving in our mailboxes and by email. Since some charities sell their contributor lists to other charities, frequent contributors may find themselves besieged by requests from all sorts of charities with which they are not familiar. Watch Out for Charity Scams – You need to be careful, as scammers out there ar… View More

This previous election has drawn historical comparisons to the election victory in 1980. Both elections underscored debates between approaches favoring government expansion and those prioritizing tax reforms and deregulation. Market reactions to both elections were positive, with the S&P 500 showing gains as confidence in the candidates’ policy proposals grew. Following the elections, markets appeared to respond favorably to policies emphasizing tax reductions and regulatory reform, while … View More

Ten-year Treasury yields bottomed at roughly 3.57% about two days before the Fed first cut its Fed Funds rate by 50 basis points on September 18th. The bad news, obviously, is that rates have backed up by 70 basis points since then. The good news is that our work has shown that this rise has been due more to expectations for stronger real growth rather than growing inflationary expectations. Unfortunately, the rate cuts have not yielded any easing in the housing market as had been hoped. Mortga… View More

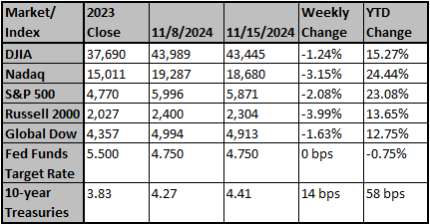

Equities fell last week (S&P 500 -1.35%), marking the second weekly decline in a row. Large technology was the drag, with Treasury yields continuing to rise. Best sectors were communication services (+1.53%) and consumer discretionary (+0.48%); worst sectors were technology (-3.27%) and real estate (-3.05%). Key Takeaways: Real GDP in 3Q was solid, growing 2.8% q/q versus 3.0% in Q2. Nominal GDP slowed to 4.7% from 5.6%. Government spending alone added 0.9%, meaning private real … View More

This phenomenon is undoubtedly a function of what Giscard d’Estaing deemed the “exorbitant privilege” of possessing the world’s reserve currency. Financially speaking, you can get away with murder. More than 54% of America’s debt matures in the next three years. The weighted average cost of our debt is 3.39%, or a level lower than every part of the yield curve. Without a meaningful decline in interest rates and inflation – or another round of QE – America’s interest expense, alr… View More

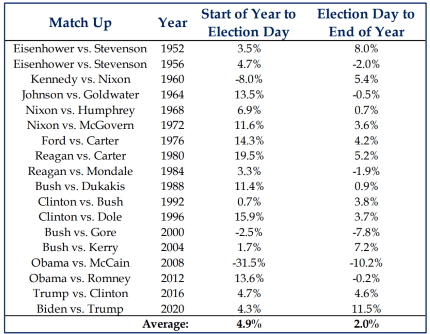

As The Strategas Washington team has repeatedly reminded us this year, election years, especially those in which incumbents are running, tend to be quite good for stocks. With only 14 days until election day and the market up almost 24% YTD, it seems like a good past will be prologue. Perhaps more interesting now is what performance might look like postelection day. As one might suspect, the average gain from election day until the end of the year is also positive, albeit smaller. There was only… View More