Quantitative Easing was different during COVID than during the Financial Panic of 2008. During COVID, M2 growth soared, while it was held back during the Financial Panic by much tighter liquidity controls on banks. That’s why we were among the first and very few who predicted much higher inflation due to COVID policies. After that, we remained wary of loosening monetary policy too aggressively because we feared that, in spite of a drop in inflation, inflation remained above the Federal Reserv… View More

Authors

Post 1 to 10 of 561

The Federal Reserve started raising short-term interest rates three years ago and the M2 measure of the money supply – what Milton Friedman said to focus on – soon started declining, hitting bottom in late 2023. One of the great mysteries of the past two years is why, given tighter money, economic growth didn’t slow down, much less hit a recession. One reason was that the federal government was engaging in the most reckless deficit spending in our lifetimes. Don’t get us wrong, we don�… View More

Trade partners lack options, prefer negotiation over retaliation China opens to talks, India and Vietnam prioritize negotiations EU considers retaliation, seeks new trade alliances U.S. trading partners have few good options in their trade war with President Donald Trump, other than to sue for peace. Hit by 10%-50% tariffs on their exports to the world's dominant economic superpower, most lack the firepower to hit back or the political will to slug it out, say government officials, econom… View More

Most Analysts Believe That Trump Tariffs Come In At Worst-Case Scenario, But Is That Really The Case?

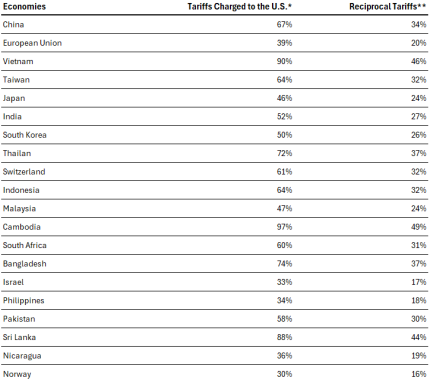

President Trump announced what he calls reciprocal tariffs yesterday, but reciprocal means the same doesn't it? Simple Definitions: reciprocal: done, given, or felt equally by both sides. reciprocal affection: related to each other in such a way that one completes the other or is the equal of the other. Full List of Countries Hit With Reciprocal Tariffs: You will note that the tariffs announced were at a 10% floor to meet most countries at Reciprocal as defined. The co… View More

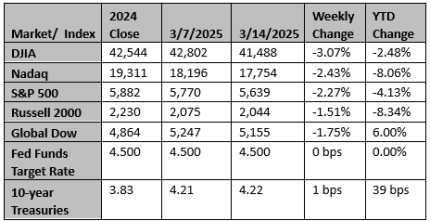

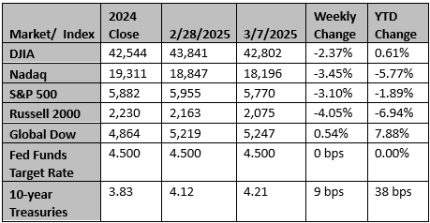

We wanted to share an update on what’s happening right now in the markets. Yesterday, at the market’s close, President Trump announced his broad-sweeping tariff plans. The market’s initial reaction is negative, contributing to today’s market drop. The first thought we want to share is that it is not atypical nor unexpected for the markets to react negatively to “change,” especially when the change is of this magnitude. President Trump’s end goal is to rewrite the book on how the … View More

During the ten years prior to COVID, PCE inflation, the Fed’s preferred measure, averaged about 1.5% per year. Jerome Powell said it was too low and he wanted inflation to “average” 2% over time. Well, he got his wish, and more. PCE inflation has averaged 3.7% in the past five years and 2.6% over the past ten years. In other words, because of its misguided policies during COVID, the Fed has pushed inflation above both its short-term and long-term target. Any apparent success at bringing i… View More

The volatile risk-off backdrop has continued. Economic concerns have surged with the U.S.-led trade war moving into high gear. The current turbulence may yet provide a good buying opportunity in risk asset markets but probably from lower than current levels. Whether equity markets rebound or continue sinking hinges on the outcome of the trade war and whether the endpoint is: a) meaningful protectionism that soon undermines the global economic expansion, or perhaps continued high uncertainty that… View More

It is true that tariffs are a tax. It is also true that tariff policies have been volatile…on and off again…different carve outs…different countries…phone calls that change things. All this clearly has an impact on the market. So, we are not surprised to see stock market volatility. However, it isn’t all about tariffs. Many major models of overall stock market valuation show that the market is expensive. The so-called Buffet Indicator, which measures the market cap of the S&P 500 … View More

Is the US already in recession? Probably not. But in the first quarter, real GDP is very likely to have a minus sign in front of it. Yes, a negative reading for real growth! Even before Friday there were some troubling signs. Retail sales fell 0.9% in January while housing starts dropped 9.8%. The personal saving rate hit a new post-COVID low in the fourth quarter, existing home sales declined 4.9% for the month and, with pending home sales (contracts on existing homes) down, February will like… View More

Global financial markets have hit a rough patch as the cumulative impact of President Trump’s trade and related economic threats are fueling concerns that he will diverge from the pro-growth script that he initially followed during his first term. Then, the positive economic elements arrived first, primarily tax cuts, before the negative actions followed, i.e., a brief trade war. These negative actions caused a downturn in global trade and slowed the U.S. economy and corporate profits. The U.… View More