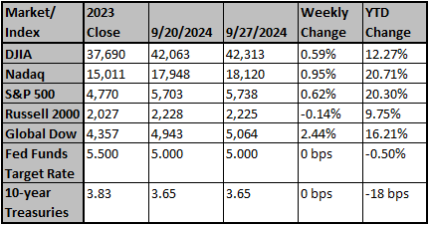

Stocks advanced again last week (S&P 500 +0.64%) as the equal-weighted index continued to outperform the cap-weighted index. The big stories last week included the China stimulus and a respectable core PCE report. The best sectors were materials (+3.39%) and consumer discretionary (+1.75%); the worst sectors included healthcare (-1.11%) and energy (-0.82%).

- The U.S. economy is beginning to struggle due to high price levels, high and rising consumer debt, and, in many industries, high inventories.

- The path to the U.S. soft landing remains to get previously impaired sectors of the economy to turn up before labor weakness causes spending to struggle.

- The vast majority is focused on the Fed's easing cycle, perhaps forgetting we are still feeling the effects of Powell’s massive tightening cycle. We are just 10 quarters after the end of tightening, a typical timeframe for the start of a recession.

- The Fed's favorite inflation gauge (PCE) rose 0.1% in August vs. 0.2%, as expected. Trailing 12 months rose 2.2% with core inflation (excluding food and energy) +2.7%.

- While earnings estimates for 2025 remain +15%, 3Q24 estimates continue to fall and are now +3.7%. down from +7.3% on July 1.

- The path of least resistance for stocks has been higher on the new Fed easing cycle and soft-landing narrative. However, valuation is being noted as increasingly demanding.

- Chinese stocks rose 4% last Monday, thanks to a collection of easing measures by their central bank (lowered reserve requirements, cut interest rates, etc.) designed to boost demand. Meanwhile. Europe shows mounting signs of weakness (especially Germany).

- The U.S. continues to dominate global equity markets, now representing nearly 65% of global equity market capitalization (MSCI), an all-time high.

- The number of S&P 500 stocks hitting a new high this quarter (339) is the highest in 22 years, indicating a market that has broadened beyond mega-cap growth stocks.

Source: Bob Doll, Crossmark Investment CEO

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed sees no 'hurry' to cut rates as confidence in economy grows, Powell says

He indicated that the U.S. central bank would likely stick with quarter-percentage-point interest rate cuts moving forward.

Reuters

US East Coast port strike looms Tuesday with no talks scheduled

U.S. East and Gulf Coast port workers are set to go on strike at midnight on Monday with no talks currently scheduled to head off a stoppage threatening to halt container traffic from Maine to Texas and cost the economy as much as $5 billion a day.

Reuters