While 2Q24 was characterized by narrow market leadership and a hawkish repricing of Fed rate-cut expectations, 3Q saw solid performance from a wider spectrum of companies and increasing expectations for rate cuts in 2024. Please see our 3Q Review below for additional insight...

3Q Review

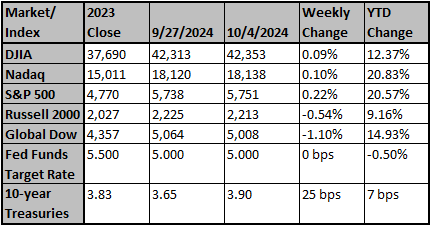

U.S. equities rose again in Q3 for the fourth consecutive quarter (S&P 500 +5.5%. NASDAQ +2.6%, and Russell 2000 +8.9%). The S&P 500 hit all-time highs in mid-July but slid in early August, rallying steadily for much of the rest of the quarter and finishing not far from new record levels. The equal-weight S&P 500 (+9.1%) fared better than the cap-weighted index, as some megacaps pared strong year-to-date gains.

While 2Q24 was characterized by narrow market leadership and a hawkish repricing of Fed rate-cut expectations, 3Q saw a solid performance from a wider spectrum of companies and increasing expectations for rate cuts in 2024. Behind this shift was a firming of expectations for an economic soft landing and a distinctly dovish Fed pivot that has the market now looking for -100 bp in total Fed policy easing this year. There was a lot of concern on the jobs front after July nonfarm payrolls printed well below consensus, while the rising unemployment rate triggered the recession-forecasting Sahm Rule.

S&P 500 companies saw 11.3% y/y earnings growth for 2Q, the highest level since 4Q21. Analysts are expecting S&P 3Q earnings to remain positive but only at a 4.3% y/y pace. The bull case remains founded on the Fed’s continuing to ease, disinflation traction, a stable (if slowing) labor market, still-healthy consumer spending, continued earnings growth prospects, and the ongoing Al secular growth theme. Bears are focused on a weakening world economy, valuations remaining extremely high, consumer confidence fraying, and some worries about when the trend might flip from slower hiring to outright downsizing. The best sectors were Utilities (+18.5%), Real Estate (+16.3%), and Industrials (+11.2%); the worst sectors were Energy (-3.1%), Communication Services (+1.4%), and Technology (+1.4%).

Recent developments

- The Fed's 50 bp rate cut has modestly increased the odds of a soft landing. However, our mainline scenario remains a significant economic slowdown or mild recession.

- Labor market conditions continue to deteriorate and credit growth remains weak. That underscores that monetary policy is tight and will remain so for a time even as the Fed cuts rates.

- The Fed has modestly raised the odds that disinflation will end or that inflation will, in fact, reaccelerate.

- The end of disinflation or the reacceleration of inflation would probably prove to be problematic for financial markets.

- China's policymakers have instituted significant measures to fight impending deflation.

Conclusion

Our market assessment remains "a high-risk momentum-driven bull market," implying investors need to participate but also need to be extra judicious in equity selection, focusing primarily on earnings quality, earnings persistence, and strong free cash flow.

| The Wall of Worry | The Offsetting Positives |

|

1. Labor market deterioration. 2. Falling consumer confidence. 3. Falling consumer savings / rising consumer debt. 4. Yield curve normalizing after long inversion (often the sign of a recession). 5. Too-high earnings growth expectations (+10% in 2024; +15% in 2025; +12% in 2026). 6. High valuation levels. 7. Massive and rising federal debt / interest expense levels. 8. Very close election. 9. Rising geopolitical tensions. 10. Threat of trade wars. |

1. Decline in inflation. 2. Central banks lowering rates. 3. Still good economic growth. 4. Strong earnings growth expectations. 5. AI / Productivity. |

Source: Bob Doll, Crossmark Investment CEO

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Japan leads Asia stock rally, dollar gains after blowout US payrolls

Asian stocks rallied and the dollar reached a fresh seven-week peak on the yen on Monday after blowout U.S. labour data dispelled fears of a recession and spurred a sharp paring of rate-cut bets.

Reuters

Hedge funds buy health care and sell real estate, says Goldman Sachs

The XM Research Desk, manned by market expert professionals, provides live daily updates on all the major events of the global markets in the form of market reviews, forex news, technical analysis, investment topics, daily outlook and daily videos.

Reuters