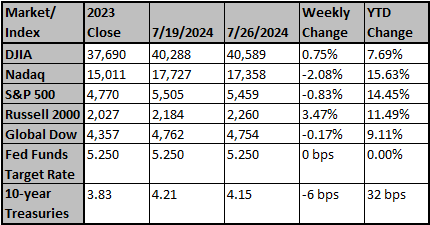

U.S. equities were mixed again last week with the S&P 500 (-0.82%) and NASDAQ lower (- 2.08%) and the small cap Russell 2000 (+1.77%). Big tech/momentum were the biggest decliners. Best sectors were utilities (+1.47%), healthcare (+1.41%), and materials (+1.37%); underperformers included communication services (-3.76%), technology (-2.44%), and consumer discretionary (-2.31%).

- The preliminary release of Q2 2024 U.S. GDP surprised to the upside (+2.8%) with the two largest drivers of the improvement consumption and inventories.

- Housing shows no signs of recovery. Existing home sales came in weaker than expected in June - back to cycle lows. Affordability remains a major issue.

- A rise in consumer credit is noteworthy in an environment of a softening labor market and dwindling excess savings.

- We have been saying for some time that the U.S. economy is slowing. Clearly, it is small cracks, not big cracks. Therefore, the jury is still out on whether this will be a soft or bumpy landing.

- The Fed is getting closer to beginning the process of recalibrating monetary policy. Recent commentaries strongly point to a September rate cut, with July’s meeting being used to prep the markets that a series of cuts are on the horizon.

- The U.S. yield-curve is its least inverted in two years. That generally happens on the eve of a recession.

- AI is making/will make a difference over time, but—productivity gains from the rollout of a new technology can take time; a broad-based expansion in earnings driven by a new technology almost always takes more time to materialize; and the early beneficiaries of a new technology may not end up being the final winners.

- Earnings estimates for the second half of 2024 (2H24) are seeing revisions lower, with 3Q coming down 1.4% since July 1 and 4Q coming down 0.2%. A bigger concern is the decline in multiples for big tech due to Al concerns.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed likely to hold rates steady one last time as inflation fight finale unfolds

The Federal Reserve is expected to hold interest rates steady at a two-day policy meeting this week but open the door to interest rate cuts as soon as September by acknowledging inflation has edged nearer to the U.S. central bank's 2% target.

Reuters

US stock turbulence throws spotlight on Big Tech's valuations

A bruising selloff in U.S. stocks is putting a sharper focus on valuations of the tech names such as Nvidia and Microsoft that have driven markets higher for most of this year.

Reuters