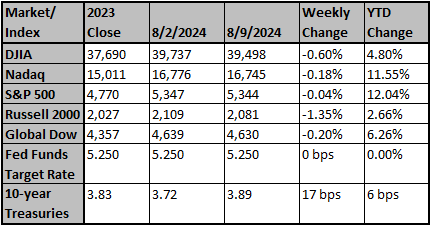

Stocks were down last week (S&P 500 -0.02%), although they nearly recovered from a significant decline on Monday (worst day in two years). A weaker-than-expected payroll report ignited fears about a behind-the-curve Fed and a potential hard landing. Best sectors were industrials (+1.22%) and energy (+1.19%); worst sectors were materials (-1.68%) and consumer discretionary (-1.00%).

- The cause of the sell-off included: escalating concerns about an economic slowdown in the U.S., heightened Mideast tensions, and increasing uncertainty about the November elections.

- The yen hit a 38-year low in early July. In response, Japan’s MOF instituted significant currency intervention, and the BOJ raised rates. The yen rebounded more than 10%, hurting carry traders who were effectively short the yen, forcing them to sell the assets they purchased with borrowed yen. This was a major factor in the magnitude and speed of the decline in the equity market.

- The latest Conference Board measure of consumer confidence suggests that consumers are increasingly downbeat about economic conditions but expect stock prices to increase over the next 12 months.

- Bank assets are now only 35% of private sector debt outstanding, down from 55% in 1980. (Private credit has picked up the difference.)

- The possibility of private credit loan problems is a debatable subject. Our view is that there are credit problems in private credit that will get exposed in a notable economic slowdown.

- An interesting factoid: Warren Buffet now owns more T-bills than the Federal Reserve.

- Macro conditions (supply and demand) continue to determine the price of oil and, therefore, energy stocks. (There seems to be no premium in energy stocks for potential disruption in the Middle East.)

- 3Q earnings gains have been cut from 8% to 5% just since July.

Source: Bob Doll Crossmark Investments CIO/CEO

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Hedge funds retrench on risk, fearful of increased volatility

Portfolio managers at hedge funds have retrenched from some of their riskier positions after a volatile week for markets.

Reuters

Wall St mixed ahead of economic data; CPI in focus

Wall Street stocks closed mixed on Monday as investors braced for a slew of U.S. economic data this week, especially consumer prices, to gauge the outlook for Federal Reserve monetary policy.

Reuters