Stocks put in a mixed performance last week as the S&P 500 increased (0.27%) but the NASDAQ fell (-0.91%). Treasuries were weaker with the yield curve steepening. Discussion revolved around AI (especially Nvidia’s earnings) and the Fed’s attempt at a soft landing. Best sectors were financials (+2.95%) and industrials (+1.71%); worst sectors were technology (-1.47%) and communication services (-0.69%).

- U.S. Q2 GDP growth was unexpectedly revised up to 3.0% from 2.8%.

- All the focus regarding monetary policy is on the Fed. Not to be ignored is the rate of growth of M2 (the Fed’s estimate of the total liquid money supply) and TGA (Treasury General Account).

- It would be a first-a significant Fed rate-cutting cycle at the same time earnings are growing 15% (the consensus expectation).

- Over the last 12 months, more than 80% of net new jobs have been in government, healthcare, and education.

- We expect labor demand to continue slowing with negative feedback loops, pushing the unemployment rate higher and culminating in a mild recession.

- We are skeptical that the upcoming easing cycle will produce a soft landing. Economic conditions are currently responding to the previous tightening cycle and this new easing cycle is likely to be too little, too late.

- While money market assets are at record levels, they represent only 13% of S&P 500 market cap. down from a peak of 64% in 2010.

- According to BCA Research, the S&P 500’s current valuation stands at the third percentile of historic distribution (i.e., valuations are exceptionally stretched).

- Nvidia's much anticipated earnings were better than expected, along with a $50 billion buyback announcement. The initial reaction was to sell the stock, as technology leadership continues to wane. (Financials picking up the leadership baton.)

- Berkshire Hathaway (Warren Buffett's company) became the first non-tech stock to reach $1 Trillion in market value.

Source: Bob Doll, Crossmark CEO

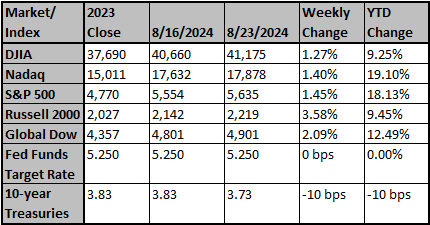

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Corporate America has a revenue problem

Nvidia's share price slump after its strong, but not exceptionally strong, second-quarter results raises a broader question for U.S. stocks: Are 2025 earnings growth forecasts too optimistic?

Reuters

US manufacturing mired in weakness; construction spending falls

U.S. manufacturing contracted at a moderate pace in August amid some improvement in employment, but a further decline in new orders and rise in inventory suggested factory activity could remain subdued for a while.

Reuters