Looks like this was just primping from the Fed in an election year and now we need to deal with reality. The bond market is always right, and it is indicating that rates are probably not going lower, and inflation is probably not in our rearview mirror.

Lower returns in the year ahead seem inevitable, especially given already rich equity valuations and prospects for higher bond yields. Inflation will prove stickier and higher than central banks and markets are forecasting. That implies that central banks will cut rates by less than markets are discounting, with some possibility that the Fed could be forced to hike interest rates by the end of this year.

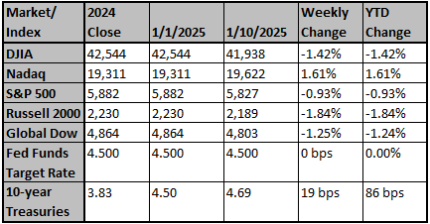

The crosscurrents of ongoing economic expansion and higher bond yields signal that equity markers will be choppy in 2025. Rising earnings will provide underlying support, but expensive U.S. stocks are especially vulnerable to a further increase in U.S. Treasury yields.

While we expect president-elect Trump to emphasize growth over disruption, his expected daily social media commentary will inevitably create periodic capital market volatility. Geopolitics is also a wildcard, with the prospect of a halt to the Ukraine and Middle East wars potential positives, while tensions between China and U.S. are at risk of intensifying.

Source: Bob Doll, CEO, Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US tightens its grip on AI chip flows across the globe

The U.S. government said on Monday it would further restrict artificial intelligence chip and technology exports, divvying up the world to keep advanced computing power in the U.S. and among its allies while finding more ways to block China's access.

Reuters

S&P 500, Nasdaq fall as investors dial back bets on Fed rate cuts in 2025

U.S. stocks declined on Monday, with the S&P 500 hitting a two-month low as bond yields surged following strong payroll data last week, reinforcing bets that the Federal Reserve will maintain a hawkish stance through most of the year.

Reuters