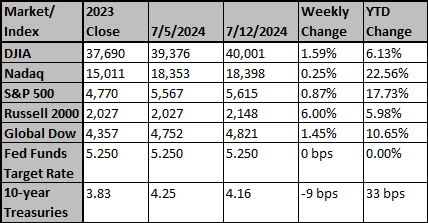

Stocks ended higher last week (S&P 500 +0.87%), with small caps and equal-weight S&P 500 strongly outperforming the other major indexes following the post-CPI rotation out of big tech. The best performers were real estate (+4.37%) and utilities (+3.90%); the only negative sector was communication services (-3.57%).

- Headline June CPI declined 0.1% m/m (versus consensus of +0.1%) (up 3.0% y/y). It was the first monthly drop since July 2022. Core CPI was +0.1% m/m (+0.2% consensus) and 3.3% y/y.

- The June payroll report was disappointing, with the employment rate rising to 4.1%, the highest reading since November 2021. (Up from the 3.4% low in late 2022.) (Job growth exceeded expectations by 16,000 jobs, but 111,000 jobs revised the prior two months down.)

- The ISM manufacturing PM I ticked lower in June, from 48.7 to 48.5. The production, employment, and new report orders subcomponents all contracted, and new orders declined for a third consecutive month. The ISM Services PM I plunged from 53.8 to 48.8, its fastest pace of contraction since May 2020, far below expectations.

- The Fed no longer has the luxury of focusing purely on inflation as the labor market weakens.

- An increasing number of economic disappointments coupled with a few good inflation reports suggest to us that the Fed will cut in September and December.

- The Atlanta Federal Reserve GDPNow model estimates 1.5% annualized GDP growth in Q2, down from 4.2% in early May.

- We expect continued softening in the U.S. economy will lead to decelerating wage growth, which is the principal consumption driver. This will likely eventually lead to a recession.

- Early 2Q earnings reports (the banks) were disappointing.

- Stock prices "should” have been falling on the recent batch of weaker-than-expected economic news, but the bad news has been greeted as good news since it increases the odds that the Fed will start easing monetary policy sooner rather than later. In other words, investors are counting on the "Fed Put” again.

- President Biden spent the better part of the week rejecting calls for him to exit the race, while former President Trump survived an assassination attempt.

Source: Bob Doll, Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

China's economy falters as property, consumer pain worsens

China's economy grew much slower than expected in the second quarter, as a protracted property downturn and job insecurity knocked the wind out a fragile recovery, keeping alive expectations Beijing will need to unleash even more stimulus.

Reuters

Trump documents case dismissed, vice presidential announcement soon

A U.S. judge dismissed one of Donald Trump's criminal cases on Monday, handing the Republican presidential candidate a major legal victory just hours before he was due to reveal his vice presidential running mate.

Reuters