Price Of Oil Most Stretched Since 1990

It’s no secret that the price of oil has skyrocketed over the last week and now stands at roughly 60% above its 200-day moving average. This is the most stretched it has been since the 1990 oil price shock when Iraq invaded Kuwait. During that period, the price of oil more than doubled in 3 months and stayed elevated for nearly six months.

1990 Saw A 20% Correction & A U.S. Recession

During the 1990 oil shock, the S&P 500 corrected 20% and the U.S. entered a recession. While the S&P 500 is down -11.9% from its January 3rd peak, there could be further for the index to fall. Perhaps the scary part is that in 1990, the Fed funds rate was 8% and eventually embarked on an easing cycle. Today, the Fed is at the beginning of a hiking cycle. It seems more and more likely a recession is unavoidable.

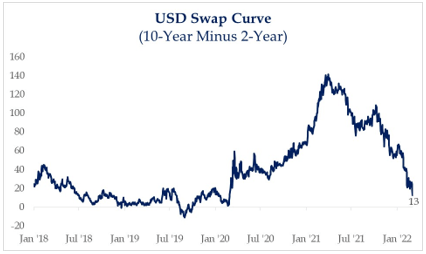

Swap Curve Even Closer To Inversion Than Treasury Curve

We certainly are not experts on the swaps market but thought it was important to point out that the 2/10 swap curve is even closer to inversion than the 2/10 treasury curve. With investors watching the curve closely as it has historically been a powerful predictor of recessions, this is just another metric to watch as growth expectations slow and the Fed readies to begin its hiking cycle.

“Recession” Is Not Priced Into The Markets

Looking at the Bloomberg story counts for “Recession” suggests that the idea is not widely discussed at the moment. While there has been a uptick over the last two weeks, the current story count is below the levels from 2013 to 2018. The spike in 2019 was when the yield curve inverted and 2020 of course was when the world shut down. We look for this to move higher over the coming weeks, all else equal.

Public commentary from the Fed, along with discussions with our own sources familiar with Fed policy, lead us to believe that investors in common stocks and risk assets will not be able to rely on the famed “Fed put” until inflation and inflationary expectations are subdued. To put a finer point on it, the Fed’s preferred inflation measure, the Core PCE, would need to drop to something close to 3%, as opposed to the current 5.2%, for investors in risk assets to expect any sort of deliverance from global central banks. We are currently forecasting five rate hikes from the Fed in the remaining seven meetings in 2022. The Chair’s own testimony would suggest that is unlikely to stop tightening until the Fed Funds rate is near its inflation target of 2.5%.

If history is any guide, the Fed will tighten until something sufficiently large in the financial system breaks to change the course of inflation and inflationary expectations. Wage, rent, food, and energy inflation appear to be beset by structural forces (especially in light of the war in Ukraine) that will be difficult to rein in regardless of what happens to securities prices. With the CPI at 7.5%, the Fed believes it has more of a duty to protect ordinary Americans from the regressive tax of inflation than bailing out investors. With this in mind, there is a better than even-money chance that the highs for the S&P 500 have already been put in for the year. In this environment, we would stay close to shore with high-quality shorter-duration stocks whose dividends offset the deleterious impact of inflation. We continue to favor the Energy, Basic Materials, and Industrials sectors. We also favor certain industry groups within the Financials, particularly regional banks. Naturally, the war in Ukraine renders this a highly fluid situation.

Our caution should not yet be considered outright bearishness due to the magnitude of the equity risk premium. It is also difficult to get outright bearish on the economy since we just added +700lk jobs m/m and job openings remain elevated. The two 50% declines in the broader market in the first decade of this century were associated equity risk premium levels that were far lower than where we stand today. With the earnings yield on the S&P 500 currently 4.7% using trailing EPS and 5.2% using forward, both are significantly higher than the current yield on the 10-year Treasury of 1.73%.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Global Markets Fall After Oil Hits $130 a Barrel

U.S. stock futures and global equity indexes dropped after Russian forces intensified strikes across Ukraine and as the threat of a potential ban on imports of Russian oil helped spur a s...

The Wall Street Journal

Global Economy Braces for Impact of Russia's War on Ukraine

Central banks are delaying or softening rate increases after relying on easy money to get through the Covid-19 pandemic.

The Wall Street Journal

February's jobs report shows a gain of 678,000.

With the decline in coronavirus cases, forecasters say the U.S. economy appears to be returning to something resembling normal.

The New York Times