- Trade partners lack options, prefer negotiation over retaliation

- China opens to talks, India and Vietnam prioritize negotiations

- EU considers retaliation, seeks new trade alliances

U.S. trading partners have few good options in their trade war with President Donald Trump, other than to sue for peace.

Hit by 10%-50% tariffs on their exports to the world's dominant economic superpower, most lack the firepower to hit back or the political will to slug it out, say government officials, economists and trade experts.

This is why the vast majority of trading partners did not immediately retaliate and indicated a readiness to negotiate a face-saving compromise with Trump. Even among those that have taken counter measures, the door was left ajar to talks.

From China, which on Friday slapped extra tariffs of 34% on all U.S. goods, to Canada, which has taken limited retaliation, nations are tipped to come to the negotiating table sooner or later, given U.S. consumption is so important globally -- two-thirds bigger than EU consumption, according to World Bank data.

Other than talks, governments have limited options to protect their export industries and broader economies.

These include spending on state aid or on broader economic stimulus -- Spain announced a €14 billion ($15.5 billion) aid package on Thursday -- or looking to greener trade pastures. German officials are eyeing up Mexico, Canada and India.

But for a world already deep in state debt after years of pandemic-era stimulus spending, it will be tough for some to fund the subsidies and other financial aid required to stave off economic growth downgrades, profit warnings and layoffs.

Economists expect Beijing to unleash more fiscal stimulus to support its economy, which sells goods worth more than $400 billion a year to the United States. It will also try to develop other export markets, according to Chinese policy advisers.

"We need to strengthen our coordination with ASEAN, Japan, South Korea, EU and UK," said one Chinese adviser, speaking on condition of anonymity because of the issue's sensitivity.

Trump's "Liberation Day" tariffs took the tax imposed on Chinese exports since his January inauguration to 54%.

Even with China's economic armoury -- its financial might, domination of critical mineral and metal production for advanced industries and centrality to global supply chains -- a negotiated truce is ultimately expected, the trade adviser said.

That could take a while, given the enmity between Washington and Beijing, though there is speculation that Trump and Chinese President Xi Jinping could meet in the United States in June.

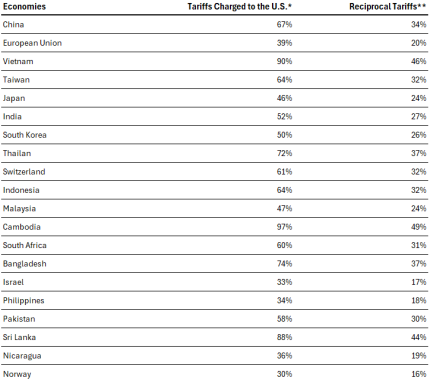

List of Proposed US Tariffs

U.S. President Donald disrupted a global trading system that had been in place fore over 75 years by introducing a new baseline 10% U.S. tariff on goods from all economies. Additionally, higher reciprocal tariff rates were imposed on some economies, based on White House figures for tariffs charged against the U.S., which they say includes considerations for currency manipulation and trade barriers.

Additional 37 rows not shown.

Note: *Tariffs charged to the U.S. include currency manipulation and trade barriers, and are according to the U.S. administration as published. **This graphic now reflects figures from the Annex of the executive order, correcting discrepancies found in earlier White House communication.

Source: The White House, United States

ECONOMIC SHOCKS

Countries lacking China's power may reach the table sooner.

India, hit with a 27% tariff, is already in talks and is not considering retaliation, said a government official. It had made concessions to Washington ahead of the latest tariffs and it is open to cutting tariffs on more than half of U.S. imports worth $23 billion in a first-phase deal, government sources said.

Vietnam, too, is expected to prioritize negotiations, with limited scope for subsidies and trade diversification. It could try leveraging the exposure that some U.S. manufacturers have to Vietnam to pressure the Trump administration, according to Leif Schneider, head of international law firm Luther in Vietnam.

But, he added, "Vietnam will likely prioritize negotiations to avoid an economic shock."

Hit by a 46% tariff, it ranks as the sixth-biggest exporter to the United States, thanks to its success as an offshoring option for manufacturers diversifying away from China.

Southeast Asia in general has nowhere to run. Its efforts to deepen trade with China, Japan and other big neighbors have led to an alphabet soup of trade groupings which facilitate trade but fall well short of compensating for a U.S. trade shock.

Ahead of Trump's announcement, China, Japan and South Korea held their first economic dialogue in five years, seeking to boost regional trade. But there is skepticism it will go far, not least because these three are exporting powerhouses, not net contributors to global demand.

LAYOFFS HAVE STARTED

The European Union, already feeling abandoned by the Trump administration over security, said the common market of 450 million people was ready to retaliate against Trump's 20% tariff against the bloc and also look to other markets.

"Forging alliances ... is the order of the day," German Economy Minister Robert Habeck said, singling out Mexico, Canada and India where closer trade relations would make sense. Trade deals can take time, though -- time that Europe and others don't have. The EU and South America's Mercosur block talked for 25 years before unveiling a free trade deal in December.

Trump's reciprocal tariffs take effect on Wednesday. It also takes time to rewire an economy to cope with global protectionism, which is what German economists say is the right response. Structural reform, such as more competition and tech investment, is preferable to state stimulus, they say.

"There is not much that either fiscal or monetary policy can do in the short term to offset the trade shock," Deutsche Bank economist Robin Winkler said. German bank Berenberg says a large part of the new U.S. tariffs can be rolled back in negotiations, with Europe offering concessions such as more contracts to U.S. defence firms.

Canada was spared additional tariffs this week but it is reeling from earlier, 25% U.S. tariffs on its auto, steel and aluminum exports. Canada is splurging on subsidies, funded by its own retaliatory tariffs, but the pain is still being felt.

European carmaker Stellantis NV STLAM.MI said on Thursday it would pause production at a Canadian assembly plant. And companies have reported that they have already started layoffs and pivoting towards newer markets.

Some nations have complained to the global trade referee, the World Trade Organisation, but that is judged a feeble option by trade experts, not least because Trump paralysed its top appeals bench in his first term. Nor is the Geneva body seen as a likely venue for renegotiating tariff disputes.

"If they keep pushing protectionism and sticking to this one-sided perspective, I don't see them coming back to the WTO for multilateral negotiations anytime soon," said Marco Molina, of consulting firm Molina & Associates and former deputy permanent representative of Guatemala to the WTO. "And that's a real shame because the WTO was literally designed to address issues like these."

Source: Ellen Zhang, Maria Martinez and Promit Mukherjee - Reuters News

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com