Is Government Spending Inflationary?

The stimulus bills approved by Congress starting in 2020 led to the largest surge in government spending in history, coinciding with a sharp rise in inflation. This has led many to assume that government spending itself caused inflation. But is that assumption correct? In today's "Three on Thursday," we explore whether government spending inherently leads to inflation. Milton Friedman famously stated, "Inflation is always and everywhere a monetary phenomenon... produced only by a more rapid increase in the quantity of money than in output."

From this perspective, it's not government spending alone that drives inflation, but how that spending is financed. If spending is funded through borrowing from the private sector, inflationary effects are limited because the overall money supply remains stable. However, when spending is financed by printing new money—expanding the money supply without a corresponding increase in economic output—inflation is inevitable. For a deeper understanding of this relationship, see the three graphics and explanations below.

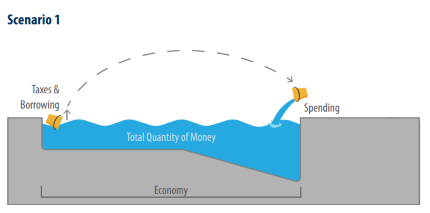

Most federal government spending is financed by the private sector through taxation or borrowing. Consider an example: the government plans to spend $100. It raises $50 through taxes from Peter and borrows $50 from Paul. Is this inflationary? No, because the total money supply in the economy hasn't changed—only its distribution has shifted.

Think of the economy as a pool, with the water representing the total quantity of money. In this scenario, the government is simply scooping water from the shallow end (via taxes and borrowing) and pouring it back into the deep end (via spending). The total amount of water in the pool remains the same; only its location has been adjusted.

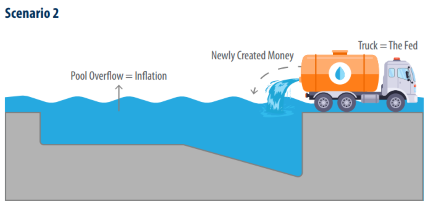

Occasionally, government spending is not only financed by the private sector but also by the Federal Reserve ("Fed"). This is where government spending becomes inflationary. Starting in 2020, government spending surged by over $5 trillion, much of it funded by the Federal Reserve creating money out of thin air to purchase Treasury bonds. This massive injection of newly created money caused the money supply to surge, driving the inflation that followed.

Using the pool analogy: typically, the government borrows from the private sector, taking a bucket of water from the shallow end and pouring it into the deep end—leaving the overall water level unchanged. In this case, however, a water truck called the Fed backed up to the pool and dumped in vast amounts of new water (newly created money), causing the pool to overflow (inflation). This dramatic increase in the money supply is the primary driver of the inflation we experienced.

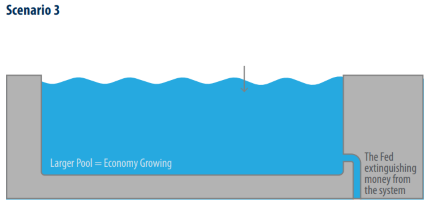

How do you lower inflation? Think back to the pool analogy: the economy is the pool, and the water level represents the money supply. Inflation occurs when too much water (money) overflows the pool (economy). To fix this, you can either drain water (reduce the money supply) or expand the pool (grow the economy).

Though the picture makes it look straightforward, draining money is difficult once the Fed puts it into the economy. It can't confiscate money. However, government can stop increasing the money supply and let the economy catch up. This will lower inflation. Deregulating or cutting taxes, may incentivize business starts, innovation and investment... all of which grow the size of the pool.

There is no guarantee that past trends will continue, or projections will be realized.

Source: This report was prepared by First Trust Advisors L.P, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Trump to announce private sector AI infrastructure investment, CBS reports

President Donald Trump is due to announce private sector investment to build artificial intelligence infrastructure in the United States totaling billions of dollars, CBS News reported on Tuesday.

Reuters

Futures climb as investors brace for President Trump's trade policy plans

U.S. stock index futures firmed on Tuesday, as investors assessed newly elected President Donald Trump's executive orders on issues including energy and immigration, while awaiting his first move on trade policy.

Reuters