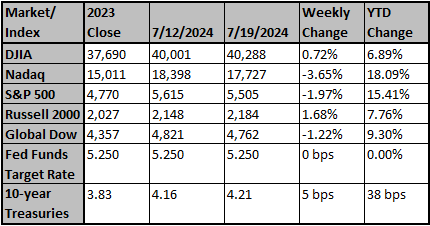

U.S. equity indexes were mixed last week with the market largely rotating out of big tech/momentum/growth into value/cyclicals/small caps. The S&P 500 Index was down (-1.95%); the NASDAQ fell (-3.65%); and the Russell 2000 Index was up (+2.33%). Themes included soft-landing hopes, expectations for a Fed rate pivot, and a surge in the “Trump trade.” Best sectors were energy (+2.06%), real estate (+1.32%), and financials (+1.19%); worst sectors were technology (-5.14%), communication services (-2.87%), and consumer discretionary (-2.68%).

- Initial jobless claims rose 20,000 in the last reporting week. While alarming at the headline level, Hurricane Beryl caused as much as half the increase. But the labor market is definitely weakening.

- The earlier in the month negative June CPI reading may be signaling some weakness in revenues and pricing power.

- Fed governors are strongly hinting at a September rate cut even before its July meeting, essentially "delivering" the September cut early as downside risks to the economy are growing.

- The Fed’s Beige Book confirmed that the deceleration in U.S. activity continues. We continue to think that investors are overstating the chances of a soft landing (e.g., P/E ratios are well into the 20s). The long and variable lags from the Fed’s massive rate hike in a short period of time have taken time to impact the economy, with more consequences to come.

- We are only into the second week of 2Q earnings reports, but estimates have already fallen from 10% to under 9%.

- In the eight days ending July 17, the Russell 2000 was up 10.4%, while the Magnificent 7 was down -7.2%. These eight days have erased roughly half of the Magnificent 7 lead over small stocks year-to-date.

- The small cap rally feels more like a trade than the start of something bigger. Earnings projections for small cap stocks are improving, but still mediocre. And the fact that companies with high short interest are outperforming suggests a short covering rally.

Source: Bob Doll, Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed may be on cusp of emerging from 'elevated' inflation blues

In September 2021, after absorbing three months of price hikes that were more than double the Federal Reserve's 2% target, U.S. central bank staff and policymakers shifted from their more passive tone about inflation and began describing it as "elevated."

Reuters

Insurers to see limited hit from CrowdStrike disruption, Fitch says

The global insurance and reinsurance industry is likely to avoid any major financial impact from the outage sparked by CrowdStrike's glitchy security software update that disrupted internet services worldwide last week, Fitch Ratings said.

Reuters