Before the long weekend, we wanted to share additional thoughts on:

- Can the US avoid recession, and can the stock market deliver positive returns in 2025?

- Consumer Confidence

- If so much good news exists, why is the market down?

- What about China and the tariffs? Won’t that cause hyperinflation?

- Isn’t the US alienating its allies and trading partners? Won’t this open the door for China to step in?

Because there is much to cover here, we’ve divided it into sections so you can jump to the information you’re most interested in if you don’t want to read it all.

1 . Can the US avoid recession, and can the stock market deliver positive returns in 2025?

Although the risk of recession has increased since the announcement of tariffs, current developments also suggest that there is a very good chance the US can get through 2025 without a recession, and that if there is a recession, it should be short-lived.

Significant investments (>$7 trillion announced so far) could increase US GDP by 1% to 1.5% annually. We use >$7 trillion because those investments have been announced since the expectation of new tariffs began. Though this article is from 2014, we wanted to share it because we feel it does a nice job of explaining how investments in infrastructure can impact the US economy. Read More

One key difference between what is discussed in this article vs. what is proposed now is that in 2014, much of the funding would have come from the government. In contrast, foreign governments or private industry will predominantly make the current investments. We view this as a substantial benefit because the US will reap the rewards of the investment, but this time, it doesn’t have to add to our deficit spending.

The stock market’s fall between April 2 and April 4 rattled many investors. Though the market’s rebound between April 4 and April 9 helped calm investors’ fears, days like April 16 brought investors’ fears back into focus. We expect volatility to continue for some time because global trade is currently undergoing what might be its biggest renegotiation thus far.

Looking at investor behavior can help investors anticipate what may come. The announcement of tariffs caused the market to fall sharply, and the suspension of many of those tariffs contributed to one of the most significant daily gains in the stock market’s history.

Today’s announcement that NVDA cannot continue to sell its H20 GPUs to China (for now) contributed to another sharp decline in the market. We can anticipate that when NVDA announces the chips have been sold and they have booked the revenue, it will increase NVDA’s (and the market’s) price. It’s important to understand that DEMAND for NVDA’s chips did not fall, but rather trade restrictions have temporarily suspended the sale of some GPUs.

Misreporting of the facts has contributed to overblown fears about what NVDA can do with its H20 chips that (for now) cannot be shipped to China. Various news sources have claimed that ONLY CHINA will purchase the H20 GPUs; however, there is clear evidence that companies like MSFT have purchased H20 GPUs from NVDA as recently as 2024. Read More

A drop in demand for AI chips and GPUs or a total loss due to natural disaster or otherwise would be much more concerning than the realization that some GPUs that were to be sold “now” will have to be sold “later.” Analysts use discounted cash flow calculations to determine the fair-market value of stocks, so an immediate drop in revenue readily explains NVDA’s fall today.

However, the same method of analysis also dictates that when the chips are finally delivered to another party (or to China if the restrictions are lifted), NVDA’s revenue will increase, and NVDA’s price will rise again.

Investing in stocks at depressed prices, whose future revenue is expected to increase, may be a great strategy for growth for investors. Planning for volatility can help investors take advantage of moves in the market like today’s.

2 . Consumer Confidence:

Weak Consumer Confidence often suggests the economy and/or stocks may experience a period of weakness, but this is not always the case. Several historical periods in the US have featured weak consumer confidence while the stock market experienced positive movement. This divergence, sometimes called the "confidence dichotomy," is well-documented and has occurred multiple times in recent decades.

Some of the notable periods in our history with weak consumer confidence while the stock market experienced gains are:

- Covid-19 Pandemic in 2020,

- the post-Great Recession Recovery from 2009 to 2012,

- the post 2022 inflation spike in 2023, and

- the stock market’s resilience in 2025 after the tariff selloff.

It’s also worth noting Consumer Confidence usually increases when:

- There is low or declining inflation. Last month, we had some of the best inflation data we’ve had in a long time. The Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE), fell to 2.2% in March from 2.5% in February despite the US levying new tariffs against Canada and Mexico.

- We have a strong labor market. Last month, despite all the turmoil, tariffs, and government layoffs, the US economy saw a net increase of 228,000 new nonfarm payroll jobs.

- We have rising income. We won’t know March’s income data until April 30, but February posted a 0.42% month-over-month increase. Income growth accelerated in February compared to the monthly average of 0.37% over the previous 12 months.

-

We have positive economic growth (GDP). Though the immediate outlook for GDP has lowered, the long-term outlook of a $7 trillion investment in the USA could be expected to increase US GDP by 1% to 1.5% per year. We use $7 trillion because those are the investments that have been announced since the expectation of new tariffs began. Here’s an interesting article if you’d like to read about the potential impact of increased spending on infrastructure in the US. Read More

Although it’s not an article about the current spending proposals, it does a nice job explaining how investments in the US can boost the economy and contribute to growth. We believe the argument is even more compelling when the investment does not have to come from the US government. AI is also expected to add materially to GDP growth, and AI’s growth has been unprecedented. Estimates from Goldman Sachs have projected generative AI could add $7 trillion to GDP over the next 10 years. They also believe AI will increase productivity, which, as an added benefit, happens to be counter-inflationary. Read More

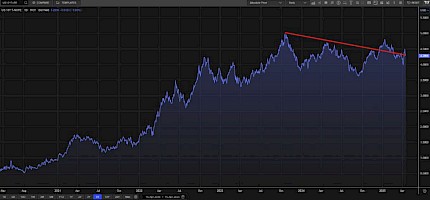

- We have stable or falling interest rates. Although interest rates have been volatile, they have fallen since October 2023. Further, if economic activity slows, the Fed’s response will be to cut interest rates. So far, Fed President Powell does not see the need to cut rates, but if data suggests we are entering a recession, the Fed should cut rates; we have no reason to believe they will not.

3 . If so much good news exists, why is the market down?

We’ve been asked, “If so much good news exists, why is the market down?”

In a word, UNCERTAINTY.

The MARKET DOES NOT LIKE UNCERTAINTY.

Most investors have a life outside of their investments. They work, spend time with loved ones, pursue personal interests, etc. To facilitate making “informed” decisions, most investors turn to one or more news sources for the information they “need” to make informed decisions about their future.

Evidence suggests that “positive” news coverage contributes to higher consumer confidence, and therefore, we must concede that “negative” news coverage will likely lead to lower consumer confidence. We, as humans, like affirmation. If we believe the economy is good, we want to see our favorite new channel report strong economic data supporting our belief.

Unfortunately, our current reality is that many of our news sources have chosen to focus on the “bad” news and projections of how “bad” they believe things may get. Here are some recent headlines prominent news channels have provided since the announcement of tariffs:

- “How Trump’s tariffs could impact the labor market: Net negative impact on employment.” -- Fox Business

- “Trump’s tariff fallout starts with layoffs, price hikes, and trade war tensions, driving a broad market sell-off.” -- CNBC

- “Stocks tumble as Trump tariffs create ‘uncertainty’ in markets.” -- ABC

- “A critical crossroads: Business leaders speak out against Trump’s trade war with the world.” -- NBC

- “The Economic Effects of President Trump’s Tariffs: GDP Down 6%, Wages Down 5%.” -- Penn Wharton Budget Model

With headlines like these predominately filling the news, it’s a wonder consumer confidence isn’t lower. Because so much “negative” press has permeated the headlines, many may be left wondering if there is even any good news to report on. We are pleased to say, there is!

Here are some examples of positive news the media “could” report, but thus far, seems to be largely avoiding.

- “As of March 7, 2025, United States (U.S.) International Emergency Economic Powers Act tariffs have been paused for goods imported from Canada that qualify for duty-free preferential treatment under the Canada-United States-Mexico Agreement (CUSMA). For the vast majority of goods (over 98% of tariff lines and over 99.9% of bilateral trade between Canada and the U.S.), traders can claim preference under the CUSMA if they meet the Agreement’s rules of origin.” Read More

- “Mexico says up to 90% of exports to the US can enjoy tariff relief.” Read More

- “EU Trade Commissioner Maroš Šefčovič described recent meetings in Washington as “very focused and productive,” with the EU reiterating its offer of zero-for-zero reciprocal tariffs on industrial goods, including cars. The talks also addressed issues like steel and aluminum overcapacity and supply chain resilience, suggesting a broad and constructive agenda.” Read More

Perhaps if the media chose to report on stories like those below, consumer confidence would be higher. The good news is that as earnings data, employment data, capital expenditures, etc., produce positive results, the news will eventually have to report the positive outcomes. When they do, we expect consumer confidence will rise.

4 . What about China and the tariffs? Won’t that cause hyperinflation?

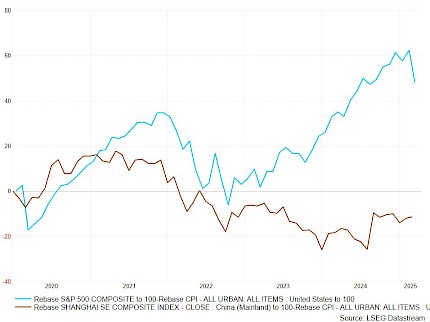

To start this discussion, we think it’s important to understand the current state of their market and ours. Since January 2020, the Shanghai Composite Index has only eked out a nominal return of 1.3% annualized vs. the S&P 500’s 11.8% annualized return. When adjusted for inflation, China’s Shanghai Composite has lost over 11% of its purchasing power. This means China’s economy is struggling with DEFLATION.

Deflation in China has contributed to falling inflation globally, particularly through trade channels and currency dynamics. China’s deflation lowers prices for its exports, which account for ~15% of global goods trade. This translates to cheaper imports for trading partners, reducing their domestic inflation.

J.P. Morgan estimates China’s deflation lowered global core goods inflation (excluding China) by 70 basis points in late 2023. The tariffs on exports to China will cause prices to fall again. Following traditional supply and demand logic, tariffs will increase the price of the goods scheduled for import, drastically reducing demand. The surplus of goods that results will subsequently cause prices to FALL. Read More

Sectors reliant on Chinese manufacturing inputs (e.g., electronics, machinery) see the strongest disinflationary effects. The yuan’s depreciation (-5% trade-weighted in 2023–2024) further reduces import prices for countries buying Chinese goods. Two-thirds of China’s exports are priced in USD, so a weaker yuan lowers costs for buyers in Europe, Latin America, and Asia. Read More

For instance, a 10% yuan depreciation could reduce EU import prices by ~3%. China’s industrial overcapacity (e.g., steel, solar panels) floods global markets, forcing competitors to cut prices. This weakens pricing power for producers worldwide, particularly in manufacturing-heavy economies like Germany and South Korea.

- Advanced Economies: Benefit from lower goods inflation but face profit margin pressures. The Eurozone’s core inflation fell by 0.4% in 2023 due partly to Chinese deflation.

- Emerging Markets: Mixed effects. Commodity exporters (e.g., Brazil) suffer from weaker Chinese demand, while manufacturers (e.g., Vietnam) face competition from cheaper Chinese exports.

Additionally, deflation can cause additional stress in the impacted economy. Here is one example:

- Debt Deflation: Prolonged deflation raises real interest rates, increasing debt burdens for governments and corporations. China’s local government debt ($12.8 trillion) and property sector defaults exemplify this risk.

Local demand can fall in countries struggling through inflation, hurting countries that export to them. This will put further downward pressure on prices, helping to pull inflation lower.

- Demand Destruction: Weak Chinese consumer spending (CPI -0.7% YoY in February 2025) reduces imports of foreign goods, hurting exporters like Germany and Australia.

China’s deflation since 2023 mirrors Japan’s 1990s "Lost Decade," where falling prices led to stagnant wages and delayed consumption. Read More

However, China’s scale amplifies global impacts: its GDP is 3x Japan’s 1990s peak. Deflation in a major economy like China lowers global inflation via trade and currency channels, but risks destabilizing debt markets and exacerbating economic stagnation.

Given the extensive research on this topic, we find it troubling that the media seems so focused on the inflation risk. Very little data supports the argument that the world is headed towards hyperinflation. We also believe this data provides a massive catalyst for countries to be motivated to work with the US on renegotiating trade agreements. Because China is such a large NET EXPORTER, it faces the most significant risk.

For those who wish to see more support for the risks China is exposed to, various reports on China have noted that the only bright spot is its massive $1 trillion export surplus. Considering that almost half of it is export surplus, which is delivered to the US, it seems highly probable that they will face further deflationary pressure as they cannot find new buyers for their exports. Even though the exemptions for electronics and chips have softened the blow, 145% tariffs still apply to 78% of all exports to the US. The tariffs effectively ended 78% of China’s trade with the US.

China’s response is a promise to stimulate domestic demand and increase trade with other countries, but neither of these accomplishments will be easy. The deflationary pressures in China are directly contradicting increased domestic consumption.

That leaves foreign trade agreements, which we will discuss in the next section.

5 . Isn’t the US alienating its allies and trading partners? Won’t this open the door for China to step in?

Yes, the announcement of tariffs has added strain to the US’s relationships with its allies and trading partners, but not anywhere near the extent China has. Maybe we are misinterpreting the news, but most news outlets seem to believe strained relations with the US are opening doors for China to step in and replace the US in those relationships.

To these claims, we can only recommend that the news and media outlets review their previous (and current) reporting on China’s interactions with the rest of the world. China’s strained relationship with most of the Western World will very likely impede its ability to significantly expand its trading relationships with the Western World.

We evaluated some of our allies' fears towards the US and China. The data shows increased concern about the US among our allies, but the concerns often raised are a fear of abandonment rather than aggression. Here is one example:

“According to a recent survey of European experts, withdrawal from Europe by the United States would be as destabilizing for the EU as a nuclear attack by Russia.” February 17, 2025 Read More

The fear towards China is on an entirely different level and almost universally highlights Chinese acts of aggression towards their countries. Though there is a tremendous amount of data about how many countries view China as a threat to national security, we limited our list to those included in our top 10 trading partners.

Sentiment towards China:

European Union Sentiment:

- The European Parliament’s 2024 study states that “China’s military threats towards Taiwan; human rights issues in China, especially in Xinjiang, Tibet and Hong Kong; and China’s position on Russia’s invasion of Ukraine… have hardened perceptions of China in the EU.” The document notes that the EU has shifted from seeking closer economic ties to focusing on “defensive economic measures” and “de-risking,” reflecting concerns about over-dependence and potential threats from China. This report was published in March 2024. Read More

- A 2025 analysis from the International Centre for Defense and Security (ICDS) explains that the EU now frames China as a “systemic rival” and a “security challenge.” The EU recognizes that China’s activities—including support for Russia, hybrid tactics (espionage, cyber intrusions, technology infiltration), and economic coercion—pose direct threats to European security and values. Feb 19, 2025 Read More

- China is asserting a stronger global role both as an economic power and as a foreign-policy actor, which poses serious political, economic, security, and technological challenges to the EU. This has significant and long-lasting consequences for the world order and poses serious threats to rules-based multilateralism and core democratic values. October 16, 2021 Read More

Canadian Sentiment:

- The Canadian Centre for Cyber Security and Communications Security Establishment (CSE) state that “the People’s Republic of China’s (PRC) expansive and aggressive cyber program presents the most sophisticated and active state cyber threat to Canada today.” China is described as conducting cyber operations against Canadian interests for espionage, intellectual property theft, malign influence, and transnational repression. The PRC’s cyber activities target Canadian government networks, public officials, and critical infrastructure to advance its strategic, economic, and diplomatic interests. Mar 4, 2025 Read More

- The Atlantic Council and the Business Council of Canada identify China as a top economic threat, citing cyberattacks, intellectual property theft, Chinese influence in Canada’s academic sector, and the weaponization of trade. These actions are seen as undermining Canada’s economic welfare and the secure functioning of its critical infrastructure. March 27, 2025 Read More

Mexican Sentiment:

- Though Mexico has not officially characterized China as a national security threat like the European Union, Canada, and the US, there is growing concern within Mexican policy circles and the media about the security implications of Chinese investment—especially in critical sectors like telecommunications, autos, and infrastructure. Additionally, Mexico has in relation to China, that “its country’s trade relationship with the US was overwhelmingly dominant and given higher priority than those with other countries.” Read More

Australian Sentiment:

- ASIO’s annual threat assessments highlight that espionage and foreign interference are at “extreme levels” and are expected to intensify, with China frequently referenced as a key actor. February 19, 2025 Read More

- Australia is rapidly upgrading its military capabilities—including acquiring long-range missiles and advanced targeting systems—specifically in response to China’s growing military presence and naval activities near Australian waters. March 13, 2025 Read More

Japanese Sentiment:

- Japan’s revised National Security Strategy, National Defense Strategy, and annual Defense White Papers explicitly state that China presents the greatest strategic challenge to Japan’s security. The NSS describes China as “the greatest strategic challenge in ensuring the peace and security of Japan and the peace and stability of the international community, as well as in strengthening the international order based on the rule of law.” Read More

South Korean Sentiment:

- South Korea’s security documents and expert analyses acknowledge that China’s military buildup, joint exercises with Russia, and support for North Korea present “distinct but interconnected challenges” to South Korea’s security. The Yoon administration’s defense policy describes a “transformed security environment” that includes China’s assertive behavior toward Taiwan and its military presence near the Korean Peninsula as factors shaping South Korea’s defense posture. April 2021 Read More

- Chinese cyber intrusions are recognized as a threat to South Korea’s national security, with reports highlighting the risks posed by Chinese hacking to government, business, and infrastructure. Jan 30, 2025 Read More

- South Korean public opinion has become increasingly negative toward China, and the government has taken steps to strengthen alliances with the U.S. and Japan, partly in response to concerns about China’s regional ambitions and coercive tactics. May 28, 2024 Read More

Vietnamese Sentiment:

- The White Paper and subsequent policy documents use careful, coded language but consistently highlight China’s aggressive actions in the South China Sea and cyber domain as serious threats to Vietnam’s sovereignty, political stability, and national security. Winter 2024 Read More

- Vietnam has publicly identified Chinese state-backed hacker groups as a major source of cyberattacks targeting Vietnamese government agencies, infrastructure, and private sector networks. The Vietnamese government frames these Chinese cyber operations as a security threat and has enacted robust cybersecurity laws and strategies in response. April 9, 2025 Read More

Indian Sentiment:

- India’s relationship with China is marked by deep mistrust, especially since the 2020 Galwan Valley clash and ongoing border disputes. Indian policymakers, military leaders, and analysts frequently refer to China as the primary security challenge facing the country. For example, the Observer Research Foundation (ORF) describes China’s “export denial strategy” as directly threatening “India’s economy and national security,” and calls for comprehensive strategies to mitigate Chinese leverage. October 13, 2024 Read More

- India has significantly increased military deployments and infrastructure along the border with China, and regularly cites Chinese military modernization and incursions as the main driver of its own defense modernization efforts. April 9, 2025 Read More

6 . Summary:

In summary, we believe the “good” news outweighs the “bad.”

Virtually every negative market report we read focuses on either inflation (the most common fear discussed), tech losses because of trade restrictions (which will be temporary – the focus on AI has not turned over), or fears of economic slowing (which will be significantly offset by investing $7 trillion in the US and efficiency gains from AI).

It is baffling to watch economists and financial experts disregard entirely the presence of deflationary pressures in China (and their impact on global inflation). We don’t want to pick on JP Morgan, but we find it curious that they continue to speak of the risk of inflation because of the “trade war” when they literally wrote a detailed analysis of how China’s deflationary pressures have been pulling global inflation down!

Here are two opposing viewpoints from JP Morgan:

Article 1 - Read More

Article 2 - Read More

It is equally baffling to watch them disregard the effects of a $7 trillion investment. We are similarly confused when we watch them ignore the rules of economics that they have stood behind for years.

In light of the deviation between current reporting and time-proven analysis, we recommend investors follow the data, not the newscast. Every month, the US reports employment data, wage data, consumption data, capital expenditures data, labor productivity data, and other valuable data points that provide insight into the economy's performance. We believe following this data will prove more useful than following the talking heads on the news.

We will strive to provide this information as it becomes available. So far, the economy continues to look healthy, and any challenges we may face along the way look like they will be short-lived. As such, we continue to believe it makes sense for equity investors to take advantage of discounts when volatility spikes. For more conservative investors, we continue to recommend investment-grade debt as a compelling investment option in the current interest rate environment we find ourselves in.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com