Is the Fed taking away the punch bowl or just priming the pump for more asset inflation?

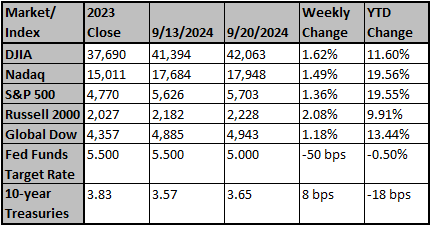

U.S. equities hit a new all-time high (S&P 500 +1.39%). Gains came in a week that saw the Fed’s long-awaited dovish pivot and data releases continuing to support a soft-landing thesis. The best sectors were energy (+3.80%) and communication services (+3.73%); the worst sectors were consumer staples (-1.18%) and real estate (-1.15%).

- The Fed lowered rates by 50 basis points (bp), the higher end of 25-50 bp expectations. In essence, the Fed is stating that its main focus now is fighting rising unemployment, having tacitly declared a near victory on inflation.

- This is the second-longest period between the last Fed rate hike and the first cut (146 days), but it is the longest for the S&P 500.

- According to Piper Sandler, the last two times the Fed cut rates 50 bp for the first cut, recessions followed.

- The combination of 10 more 25 bp cuts in Fed funds coupled with double-digit earnings growth would be unprecedented and indicate a successful soft landing.

- The economic outlook depends on the labor market and resultant consumption patterns. With labor softening (both jobs and wages) and credit levels rising, consumption is likely to weaken despite rate cuts (because monetary policy works with long lags).

- The Atlanta Fed's GDP Now model raised Q3 real GDP to 3.0% from 2.5% following the better-than-expected retail sales and industrial production reports from August.

- University of Michigan consumer confidence rose more than expected to 68.5 from 67.9.

- After the first rate cut, historically, the best sectors are consumer staples, healthcare, and utilities.

- It is possible that a mild recession or even a noticeable slowdown could lead to a more significant stock market downturn due to high earnings growth expectations and high valuations.

- Net interest expense as a percentage of tax revenue is now 17%, almost as high as the defense budget.

Source: Bob Doll, Crossmark Investment CEO

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Why Fed rate cuts matter to world markets

When the Federal Reserve delivers a widely-anticipated interest rate cut on Wednesday, its first in four years, the move will resonate well beyond the United States.

Reuters

Fed officials say risks to jobs warranted rate cut as debate shifts to pace of easing

Fed policymakers said the rate cut last week was meant to sustain an emerging and healthy balance in the economy.

Reuters