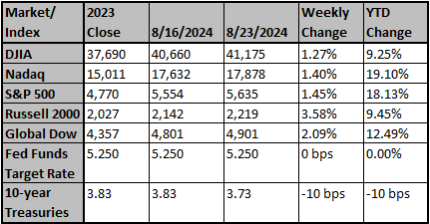

Stocks were higher last week (S&P 500 +1.47%) as all major averages gained. Most averages remained below the July all-time high. The big focus was on the Fed and Chairman Powell’s strong endorsement of lower rates. Best sectors were real estate (+3.68%), materials (+2.39%), and consumer discretionary (+2.10%); worst sectors were energy (-0.28%), technology (+1.08%), and communication services (+1.20%).

- Chairman Powell stated clearly,"... the balance of risks to our two mandates has changed," implying rate cuts are on the table starting next month.

- The Bureau of Labor Statistics (BLS) revised down the number of workers on payrolls by 818,000 over the 12-month period ending March 2024. This largest downward revision since 2009 implies that the labor market has been far less resilient than originally thought.

- The Conference Board's U.S. Leading-Economic Index (LEI) disappointed yet again, in July, contracting 0.6% m/m from a 0.2% decline in June, and below expectations of -0.4%.

- U.S. manufacturing PMI experienced its most significant contraction of the year in August.

- Although consumers perceptions of current economic conditions unexpectedly deteriorated in August, they are becoming increasingly optimistic about the future, a strange juxtaposition. (This is according to the University of Michigan monthly consumer survey.)

- Continued labor market softening will likely depress compensation growth and continue to pressure consumption. We continue to expect the jobs market's deterioration to culminate in a noticeable slowdown/recession in the next 6 to 12 months.

- Earnings growth expectations for 3Q have weakened significantly from just six weeks ago. Consensus expectations have moved from +7.3% to +4.4%.

- Small cap stocks tend to underperform going into economic slowdon/recession… but handily outperform leading out of recession.

- Price controls have a long and sordid history all over the world. The best way to fight inflation is to have the Fed focus on price stability while the government minimizes taxes and regulations to encourage competition and risk-taking. Competition, not new regulations, is the best way to keep prices down. The good news is that we think price controls are very unlikely to pass in Congress.

- One area where both political parties agree is their desire to pursue protectionism, specifically in the form of tariffs on goods from China and/or other major trading partners. We believe protectionism is bearish for risk assets, due in part to inevitable retaliation.

Source: Bob Doll, Crossmark CEO

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed's shift to job market risks is done; now policy has to catch up

In 2022, when the Federal Reserve's focus shifted to combating inflation, it had to ratchet up interest rates fast to get monetary policy caught up with fast-rising prices.

Reuters

Wall St mixed ahead of economic data; CPI in focus

Wall Street stocks closed mixed on Monday as investors braced for a slew of U.S. economic data this week, especially consumer prices, to gauge the outlook for Federal Reserve monetary policy.

Reuters