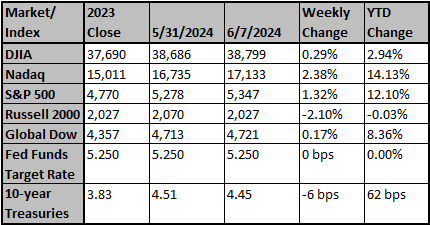

Equities advanced last week (S&P 500 +1.36%) as the S&P 500 and NASDAQ hit new all-time highs. Breadth was narrow as the equal weight S&P fell for the week. Best-performing sectors were technology (+3.83%) and healthcare (+1.96%); laggards included utilities (-3.81%) and energy (-3.41%).

- May non-farm payrolls increased 272,000 well above consensus. The unemployment rate rose to 4.0%. the highest level in over two years. Disappointing for potential Fed rate cuts, average hourly earnings increased 0.4% (4.1% y/y).

- The ISM Manufacturing PM! showed weakness: the ISM Services PMI showed strength... a continuation of mixed signals for the U.S, economy.

- Tight monetary policy typically takes a long time to impact the economy, According to BCA Research, the average lag between the first Fed rate hike and recession has been 29 months...that would place the beginning of a recession in August.

- It is more likely that the Fed will find itself behind the curve in easing monetary policy (i.e.. not cutting enough to prevent a recession), than cutting too much and reigniting inflation.

- Corporate and high-yield bonds are the fixed-income sectors that are most exposed to an economic slowdown. Markets continue to price in a Goldilocks scenario, with spreads narrowing. Already tight spreads give them little room to compress further and could widen as the economy.

- NVIDIA'S YTD return has accounted for one-third of the S&P 500's 12% return YTD.

- The median P/E of the largest five companies is 32x. The median return of the next 495 is 18x.

- While the S&P 5Q0 achieved a new all-time high last week, only 71% of the S&P 500 is above their 200-day moving average, down from 85% at the last high in March... while minor, a negative divergence, nonetheless.

Source: Bob Doll Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed's new economic projections may come with a dose of maybe, maybe not

Updated economic projections from Federal Reserve officials this week are expected to show fewer interest rate cuts than policymakers anticipated three months ago, faster expected inflation, and slower growth, a pinpoint economic outlook that will carry the weight of the U.S. central bank's authority.

Reuters

Futures dip on caution ahead of inflation data, Fed meeting

U.S. stock index futures edged lower on Monday as investors moved to the sidelines ahead of key inflation data and a Federal Reserve meeting scheduled for this week, awaiting clues on the central bank's policy-easing stance this year.

Reuters