Continuing a yearly tradition, Bob Doll, chief investment officer of Crossmark Global Investments, has released his 10 market and economic predictions for 2025.

During 2025, the economy will slow, and unemployment will creep up, according to Doll.

These are his other predictions:

- Inflation remains sticky and fails to reach the Fed's 2% target, causing Fed funds rate to fall less than expected.

- Treasury 10-year yields trade primarily between 4% and 5% as credit spreads widen.

- Earnings fail to achieve consensus (14% growth and every sector has up earnings.

- Equity volatility rises, causing the VIX average to approach 20 for only the third time in 14 years.

- Stocks experience a 10% correction.

- Equal-weighted portfolios beat cap-weighted portfolios and value beats growth.

- Financials, energy and consumer staples outperform healthcare, technology and industrials.

- Congress passes the Trump tax cut extension, reduces regulations, but tariffs and deportation are less than expected.

- DOGE efforts make progress but fall woefully short of $2 trillion per year of savings.

Investors will continue to see a bull market for now, but this may be disrupted because of contradictory policies proposed by President-elect Trump, Doll wrote in an executive summary.

“It is possible that a mix of pro-growth and disruption policies will occur simultaneously and/or the administration will toggle back and forth, thereby [creating] heightened uncertainty as well as economic and financial market volatility,” he said.

Although continued tax cuts and pro-business policies bode well for the economy, mass deportations and tariffs would be negative for growth and push up inflation, he wrote. Equities will still have positive tailwinds supported by economic expansion and earnings growth, Doll predicted, but the stock market is already pricing in an optimistic outlook for the near future, so a 5% to 10% pullback early in the year is possible.

Key questions for the upcoming year are whether the economy, earnings, the Federal Reserve and the new White House administration can deliver another strong year for investors, he wrote.

Doll recently said he was right on seven of his 10 predictions last year, which included a forecast for a shallow recession. A year ago, Doll said he was “skeptical” about the economy’s ability to achieve a happy medium in 2024.

Source: Bob Doll, CEO, Crossmark Investments

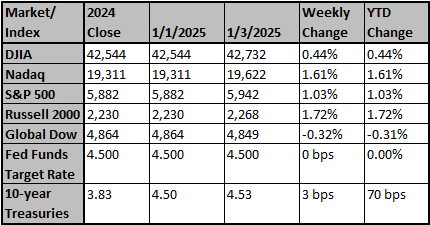

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed's Kugler, Daly say job not done on inflation

Two Federal Reserve policymakers on Saturday said they feel the U.S. central bank's job of taming inflation is not yet done, but also signaled they do not want to risk damaging the labor market as they try to finish that job.

Reuters

China services activity hits 7-month high but US trade fears dent optimism, Caixin PMI shows

China's services activity expanded at the fastest pace in seven months in December, driven by a surge in domestic demand, but orders from abroad declined, reflecting growing trade risks to the economy, a private sector survey showed on Monday.

Reuters