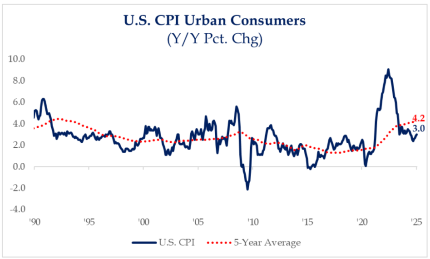

We don’t want to over-emphasize the importance of one data point, but the data over the last several months suggest that the progress toward the Fed’s much-vaunted goal of 2% inflation has slowed. In truth, the 2% target is a widely agreed-upon fiction among both policymakers and market participants themselves borne out of a New Zealand central bank paper from the late 1980s. Ironically, the target was only invoked when inflation was serially below 2% in the aftermath of the GFC. Since the … View More

February 2025

Post 1 to 4 of 4

There is nothing easy about forecasting financial markets, and when combined with a President who changes his mind in a matter of moments on policies that may a have lasting impact on sectors, industries, or specific companies, it becomes that much more challenging. Three weeks into Trump 2.0 we felt it was as good a time as any to review our sector recommendations. We feel being overweight the Financials, Industrials, Utilities and Energy sectors remains a prudent strategy. The deregulation st… View More

With the fourth quarter reporting season more than 60% reported, both earnings and sales growth have been quite strong. EPS growth is expected to be 14.8%, with 9 of the 11 sectors exceeding estimates from the start of the quarter. Sales growth is also expected to be strong overall with estimates sitting at 4.8%, with 9 of 11 sectors currently exceeding estimates from the beginning of the reporting season. While there is still 40% of the index left to report, there are few that could really swa… View More

Following 100 basis points in rate cuts through the back half of 2024, the Fed started 2025 with a pause, placing itself in wait and see mode for the foreseeable future. Starting with today’s FOMC statement, there were a few language changes worthy of note. On the employment front, prior comments that labor market conditions have eased and the unemployment rate has risen, now state that the unemployment rate has stabilized and labor market conditions “remain solid.” With regards to inflat… View More