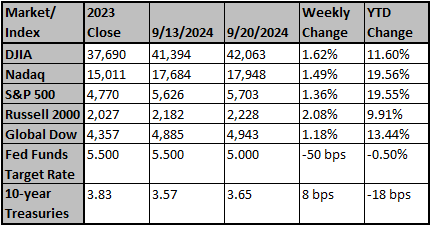

Is the Fed taking away the punch bowl or just priming the pump for more asset inflation? U.S. equities hit a new all-time high (S&P 500 +1.39%). Gains came in a week that saw the Fed’s long-awaited dovish pivot and data releases continuing to support a soft-landing thesis. The best sectors were energy (+3.80%) and communication services (+3.73%); the worst sectors were consumer staples (-1.18%) and real estate (-1.15%). The Fed lowered rates by 50 basis points (bp), the higher … View More

September 2024

Post 1 to 4 of 4

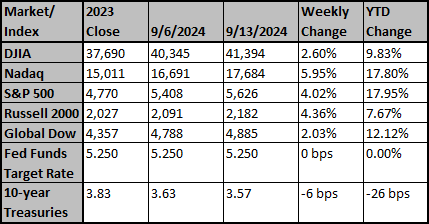

This is the second-longest period between the Fed's last rate hike and the first cut (146 days). However, the return during the current pause has been the strongest. Going back to 1995, Consumer Staples, Health Care, and Utilities have been the strongest performing sectors after the first Fed rate cut in a series. The real 10-year Treasury yield and the real Fed Funds rate are approaching levels that preceded recessions and would be considered “tight.” The price of gold has risen 35% in… View More

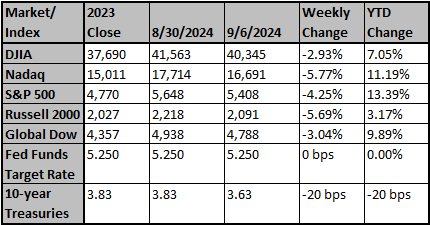

Friday’s employment report suggests the US economy may be slowing down faster than most investors think. Nonfarm payrolls increased by 142,000 in August, but revisions to June and July brought the net gain down to a modest 56,000. And the details were worse. We like to follow payrolls excluding three sectors: government, education & health services, and leisure & hospitality, all of which are heavily influenced by government spending and regulation (including COVID lockdowns and reope… View More

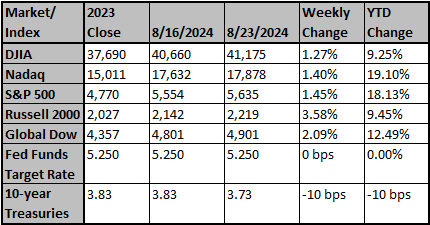

Stocks put in a mixed performance last week as the S&P 500 increased (0.27%) but the NASDAQ fell (-0.91%). Treasuries were weaker with the yield curve steepening. Discussion revolved around AI (especially Nvidia’s earnings) and the Fed’s attempt at a soft landing. Best sectors were financials (+2.95%) and industrials (+1.71%); worst sectors were technology (-1.47%) and communication services (-0.69%). U.S. Q2 GDP growth was unexpectedly revised up to 3.0% from 2.8%. All the focus… View More