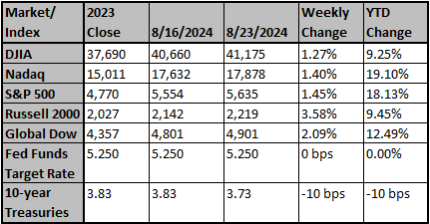

Stocks were higher last week (S&P 500 +1.47%) as all major averages gained. Most averages remained below the July all-time high. The big focus was on the Fed and Chairman Powell’s strong endorsement of lower rates. Best sectors were real estate (+3.68%), materials (+2.39%), and consumer discretionary (+2.10%); worst sectors were energy (-0.28%), technology (+1.08%), and communication services (+1.20%). Chairman Powell stated clearly,"... the balance of risks to our two mandates has … View More

August 2024

Post 1 to 4 of 4

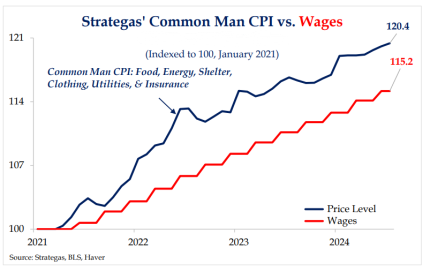

Our research provider follows inflation, which affects us every day. The Strategas Common Man CPI is comprised of items people must buy each day, week, or month – food, energy, shelter, children’s clothing, utilities, and insurance. Real wages may have started to improve recently, but the cumulative effects of inflation indicate that the “common man’s” standard of living has deteriorated in the last four years. January 2021 January 2017 Source: Strategas Chart ref… View More

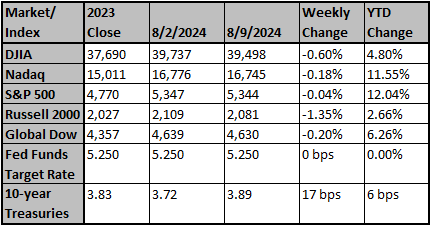

Stocks were down last week (S&P 500 -0.02%), although they nearly recovered from a significant decline on Monday (worst day in two years). A weaker-than-expected payroll report ignited fears about a behind-the-curve Fed and a potential hard landing. Best sectors were industrials (+1.22%) and energy (+1.19%); worst sectors were materials (-1.68%) and consumer discretionary (-1.00%). The cause of the sell-off included: escalating concerns about an economic slowdown in the U.S., heighten… View More

There are certainly pockets of the market more deeply oversold than others after the last few days, but on balance, we’d still stop short of calling this enough of a rinse to really lean into yet. It might be an easier call if it was October, but we frankly struggle to think of many markets that have put in their corrective lows in early August. Here’s a summary of our current thinking, but reach out with questions or requests—we’re available to help in any way. On a scale of 1 to… View More