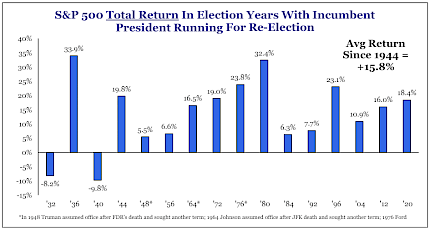

Now that we are past Memorial day in an election year, all eyes are on the upcoming election. We get a lot of questions as to what the market usually does in election years. I thought it would be helpful to share some information on what we should expect. Macro/Pre-Election: Policymakers Will Keep Liquidity/Stimulus Flowing In 2024 S&P 500 has increased in every presidential reelection year since 1944 as sitting presidents stimulate the economy ahead of their reelection. Average retu… View More

May 2024

Post 1 to 5 of 5

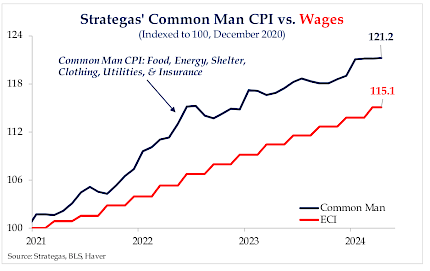

The primary justification for excluding food and energy from the Bureau of Labor Statistics’ “core” CPI number is that the data are noisy and, therefore, difficult for economists to forecast. Naturally, that raises another question: Does the data exist for economists and policymakers to make their decisions, or do they exist for regular people when deciding how to run their economic lives? Excluding food, energy, and housing from the “supercore” measure seems a little much because, le… View More

One theory making the rounds is that if President Trump gets back into office, inflation will surge. The idea is that if he returns, Trump will raise tariffs, reduce immigration, and jawbone the Federal Reserve to cut interest rates too much, all of which could push inflation higher, maybe even to where it was a couple of years ago when it peaked at 9.1%. We are certainly not optimistic about the path of inflation in the decade ahead. The Consumer Price Index (CPI) went up at only a 1.8% annual… View More

In a volatile week, equities advanced (S&P 500 +0.56%) for the second straight week. On generally good earnings reports, big-cap tech stocks were the standout. The best sectors were utilities (+3.44%) and consumer discretionary (+1.60%); the worst sectors were energy (-3.27%) and financials (-0.58%). While we think Goldilocks will remain a fairytale, the April employment report certainly exhibited Goldilocks characteristics (job growth slowed to a still respectable 175,000, and averag… View More

No shortage of things to discuss after today’s Fed statement and subsequent press conference. While the Fed did not cut rates – and nobody expected them to – today’s focus was on how the Fed would respond to the turn higher in inflation to start 2024. But for all the questions, there was a distinct lack of clear answers. Let’s look first at today’s Fed statement, which included more changes than usual. In particular, a new sentence was added noting that “there has been a lack of f… View More