This phenomenon is undoubtedly a function of what Giscard d’Estaing deemed the “exorbitant privilege” of possessing the world’s reserve currency. Financially speaking, you can get away with murder. More than 54% of America’s debt matures in the next three years. The weighted average cost of our debt is 3.39%, or a level lower than every part of the yield curve. Without a meaningful decline in interest rates and inflation – or another round of QE – America’s interest expense, alr… View More

October 2024

Post 1 to 5 of 5

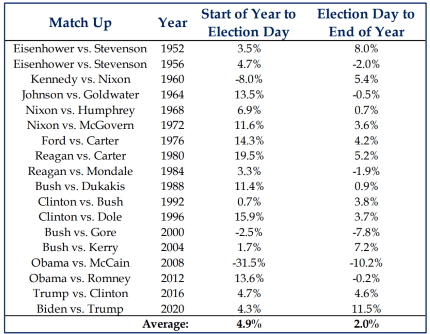

As The Strategas Washington team has repeatedly reminded us this year, election years, especially those in which incumbents are running, tend to be quite good for stocks. With only 14 days until election day and the market up almost 24% YTD, it seems like a good past will be prologue. Perhaps more interesting now is what performance might look like postelection day. As one might suspect, the average gain from election day until the end of the year is also positive, albeit smaller. There was only… View More

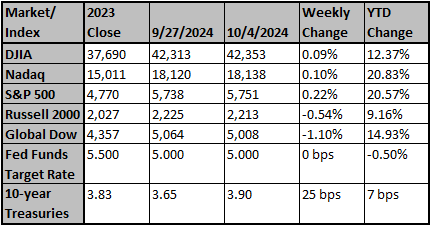

U.S. equities rose for the fifth week in a row (S&P 500 +1.13%) closing at an all-time high. Banks were strong as Friday earnings boosted the stocks. Treasuries were weaker (the 10-year yield is up 35 basis points [bps] over the past eight sessions.) Best sectors were technology (+2.51%) and industrials (+2.11%); worst sectors were utilities (-2.55%) and communication services (-1.28%). Key takeaways: Core CPI was +0.3% (above consensus of 0.2%). Headline CPI was +0.2% (above con… View More

While 2Q24 was characterized by narrow market leadership and a hawkish repricing of Fed rate-cut expectations, 3Q saw solid performance from a wider spectrum of companies and increasing expectations for rate cuts in 2024. Please see our 3Q Review below for additional insight... 3Q Review U.S. equities rose again in Q3 for the fourth consecutive quarter (S&P 500 +5.5%. NASDAQ +2.6%, and Russell 2000 +8.9%). The S&P 500 hit all-time highs in mid-July but slid in early August, rallyin… View More

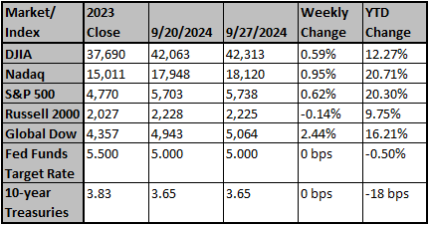

Stocks advanced again last week (S&P 500 +0.64%) as the equal-weighted index continued to outperform the cap-weighted index. The big stories last week included the China stimulus and a respectable core PCE report. The best sectors were materials (+3.39%) and consumer discretionary (+1.75%); the worst sectors included healthcare (-1.11%) and energy (-0.82%). The U.S. economy is beginning to struggle due to high price levels, high and rising consumer debt, and, in many industries,… View More