With the fourth quarter reporting season more than 60% reported, both earnings and sales growth have been quite strong. EPS growth is expected to be 14.8%, with 9 of the 11 sectors exceeding estimates from the start of the quarter.

Sales growth is also expected to be strong overall with estimates sitting at 4.8%, with 9 of 11 sectors currently exceeding estimates from the beginning of the reporting season. While there is still 40% of the index left to report, there are few that could really sway the EPS figure. It would be safe to say that 4Q saw double digit growth again.

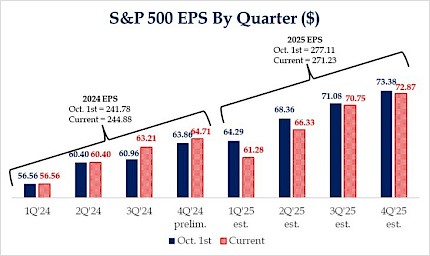

First Material Revisions To 2025 EPS Came Last Week

Despite a strong reporting season, the 2025 EPS figure saw its first material revision in overall EPS last week. To be fair it wasn’t a broad based decline in EPS for each quarter, but rather 1Q was revised lower due to 4Q being strong. 2025 EPS now sits closer to $271, which equates to a growth rate of 10.8%. Our view is that estimates will continue to come in this year as we believe earnings could be closer to $266.

Large Caps Far Less Interest Rate Sensitive

Much attention has been given to interest rates, as it should, but they are much more significant for the small cap trade than they are for large caps. Over the past 6+ months interest expense as a percentage of total debt for the S&P 500 has been roughly unchanged at 4.2%, while small caps saw the same figure rise to greater than 7%.

Today, it sits on the 7% level for small caps, but companies continue to look for a reprieve. We suspect this number should continue to slowly decline but large caps remain less sensitive here. With no major maturity wall for large caps, this appears to be more of a normalization.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Asian and EU steelmakers' shares fall after Trump escalates tariffs

Shares in European and Asian steelmakers fell on Monday after U.S. President Donald Trump said he would introduce 25% tariffs on all steel and aluminium imports within hours in addition to existing metals duties.

Reuters

Futures rise as markets shrug off Trump's latest tariff threat; steelmakers jump

U.S. stock index futures ticked up on Monday, recovering some losses after the last session, with steelmakers leading the gains after U.S. President Donald Trump said he would impose additional tariffs on steel and aluminum imports.

Reuters