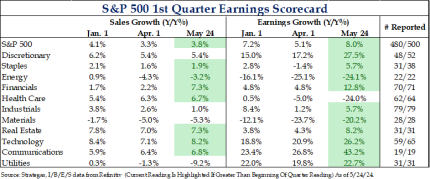

After Nvidia reported last week, the first quarter earnings season is nearly complete, and overall, it was strong. The overall index grew at 8.0%, which was better than the January 1st expected growth rate of 7.2%. Revenues were at 3.8%, a touch lighter than the January 1st estimate of 4.1%, with the drag coming from Utilities and Materials. Despite not having strong growth rates, financials were the standout sector as their growth expectations exceeded estimates even before the collapse of SVB last year. Healthcare was the notable laggard.

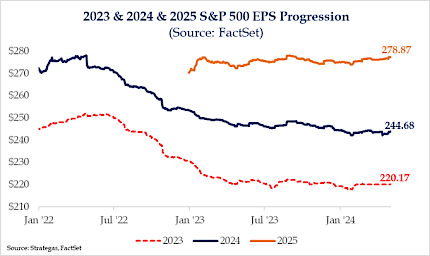

2025 Has Yet To See Downward Revisions

Breaking from the traditional downward EPS trend that the annual EPS progressions usually show, 2025 estimates continue to climb higher, now sitting at $278.87. This would equate to a 14% growth rate for next year, after an 11% growth rate expected this year. Furthermore, if you were to apply today’s multiple to the 2025 EPS figure, that would suggest that +6,000 on the S&P 500 is not unachievable.

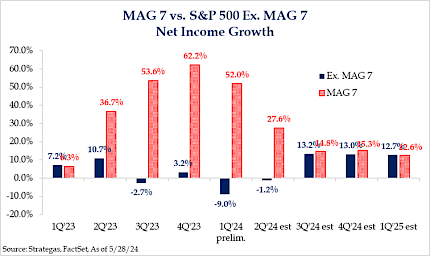

Ex. Mag 7 Earnings Growth Projected To Catch Up

While the Magnificent 7 have been the driver of net income growth over the last 4 quarters, the consensus estimates suggest that this is going to change in the 2nd half of the year and into 2025. Of course, the capex being spent on “AI” benefits the largest companies most so the growth will likely continue for them, but a broadening of earnings growth would be a positive for equities overall. Health Care is a sector in particular where the comps are easier and it’s difficult to recall an election year in recent time where Health Care was not in focus. Perhaps an opportunity lies there currently.

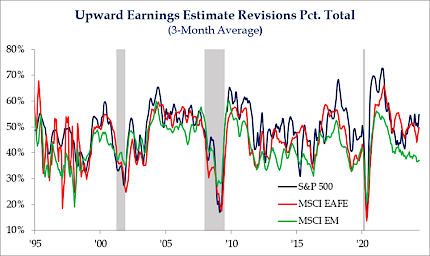

Developed & Emerging Markets Earnings Revisions Diverging

Looking at global earnings revisions shows that in the United States and Developed International, earnings revisions have moved higher and at the very least have stabilized. Emerging markets’ on the other hand have continued to trickle lower. While EM is heavily exposed to China, and there is some hope that the market is turning higher, we are always cautious about how long the rallies can last given the historical tendency for them to fade rather quickly. Perhaps we are in the midst of another head fake, but we will continue to watch the China credit impulse which hasn’t moved higher as of late.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed seen more likely to cut rates in Sept after PCE data

The Federal Reserve is more likely to deliver a long-awaited rate cut in September after a U.S. Commerce Department report showed inflation made a bit of progress toward the Fed's 2% goal last month and spending softened, traders expect.

Reuters

Megacaps boost Nasdaq futures as summer trading begins

Nasdaq futures led Wall Street gains on Monday and were set to begin June's first trading day on a positive note as megacap growth stocks rose, recovering some ground after closing Friday's session in the red.

Reuters